Someday…

If you’re like me, estate and emergency planning is a task that’s forever on your to-do list.

You know it’s important (critical, even) but there are dirty dishes to do, bills to pay, and Netflix series to binge! All of us are busy, so we put it off with the plan to get to it ‘someday’.

Problem is, ‘someday’ never seems to come. There’s always something more urgent or entertaining to get to… but all the while, that niggling sense of worry never goes away.

What if?

That worry we have is there for a reason—we know full well the challenges our family would face if we were gone. “What if?” goes through our minds, and we imagine the difficulties and hardship, but we still fail to act.

I get it and have been there myself. Estate and emergency planning is a big, overwhelming task! It’s hard to know where to start or what to do. Even though we know we need to deal with it, the inertia is too great!

So how about we consider some different “What ifs” today? What if there was a tool to make the planning easier, simpler and even kind of fun? What if this magical tool was a breeze to use and affordable too? What if I told you it exists, I’ve used it myself, and love it?

Well, all of the above is true, and I’ve written a detailed review so you can decide if it’s the right product for you.

Disclosure: This post includes affiliate links, which means I may receive a commission if you make a purchase. There’s no extra cost to you, and you’ll be helping to support this blog. Thank you!

Order the Family Emergency Binder

Order your copy of the Family Emergency Binder for only $39! (Or, purchase the binder on a USB drive for $59.)

Prices shown are in US dollars.

The Family Emergency Binder

I first heard about the Family Emergency Binder in 2019 and knew it was exactly what I needed. You see, despite my best efforts to simplify our finances, they’re anything but simple!

We have multiples of everything: bank accounts, credit cards, and investment accounts. If I were wiped off the face of the Earth or knocked into a coma tomorrow, I’d fear for the sanity of whoever was tasked to sort out our financial matters!

As the sole caretaker of our family’s finances, no one else knows how to deal with our money—not even my husband. (As much as I’ve tried to get him involved, he’s just not interested.) This situation is more than a little worrisome.

Why every family needs this binder

The Family Emergency Binder makes it so easy to help your loved ones deal with your finances (and more) in your absence.

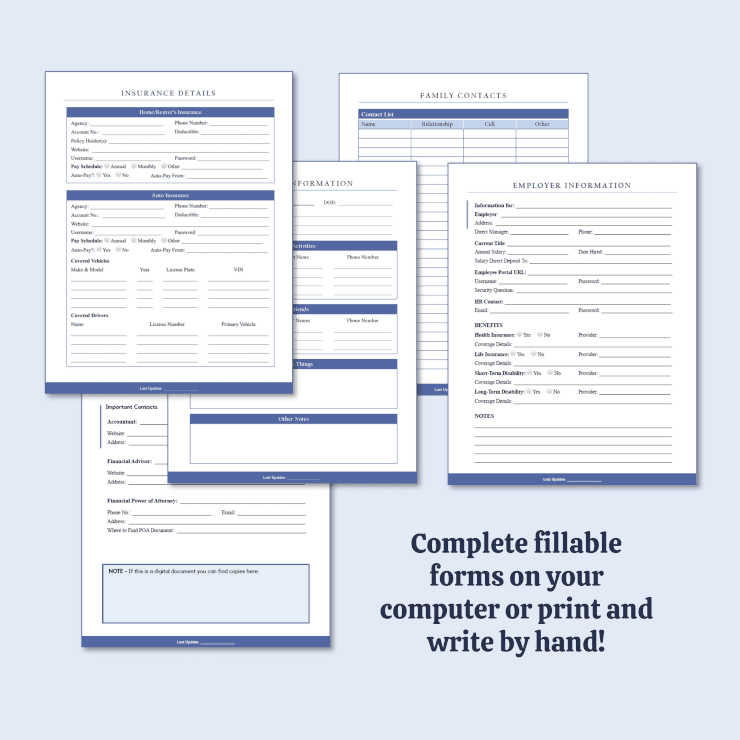

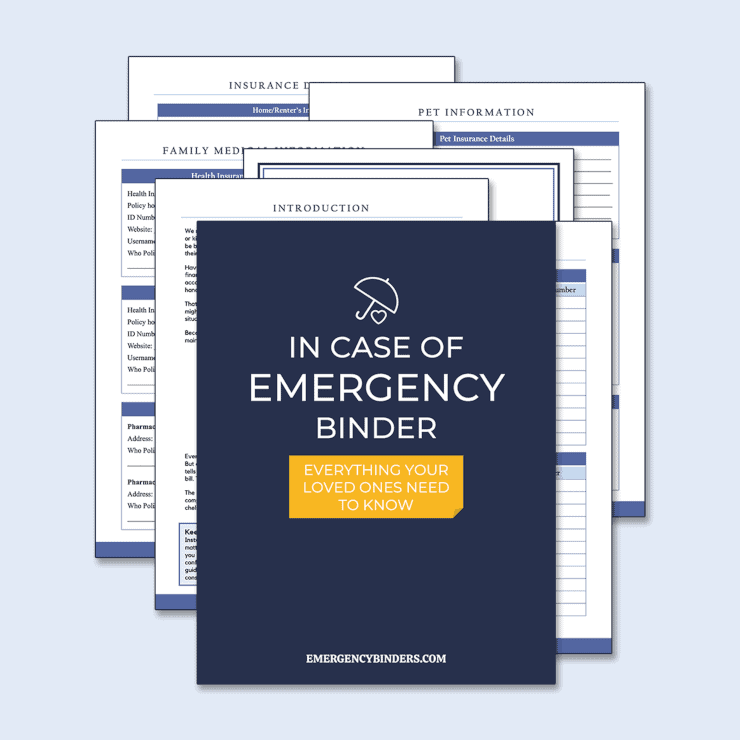

It comes in the form of a beautifully-designed, fillable PDF. You can keep it in digital form, or print it out to create your own binder. (I’d highly recommend doing so, for quick and easy access).

This binder makes it as painless as possible to get started with your estate and emergency planning. It’s organized, thoughtfully-planned, and easy to fill in. You’ll wonder why it took you so long to get to this important task!

Family Emergency Binder: My detailed review

If you’re still reading, you’re probably wondering about the ‘review’ that’s mentioned in the title. Here it is:

What is it?

The Family Emergency Binder is a 100+ page PDF designed to guide you through the process of collecting your family’s vital information. The pages are comprised of thoughtfully-designed, fillable forms that you can print out to create your own ICE binder.

Who created it?

Chelsea Brennan from Smart Money Mamas (formerly Mama Fish Saves) created the Family Emergency Binder. In her words, this is why she decided to create it:

“As I saw some people I cared for go through difficult times, I worried for my husband and my boys. I craved some security. To, at the very least, learn something from their struggle.

So, I created a binder that organized all the information of our complicated lives. I made it easy for anyone to step in and keep life stable if something happened to me.”

Who’s it for?

While the binder’s tailored to families with children, it’s useful for everyone. If your life includes any of the following, you need the Family Emergency Binder:

- Children, pets, or other dependents.

- Bank accounts.

- Credit cards.

- Debts.

- Investment accounts.

- Investments.

- Insurance policies.

- A will.

- A power of attorney.

- A medical directive.

- Social media accounts.

- A website.

- Specific burial/memorial wishes.

Who’s it not for?

In some situations, the Family Emergency Binder may not be useful:

- You have other estate documents which outline the same information.

- You know at least two trusted people who have complete access to your financial accounts and understand them as well as you do.

- You don’t plan to leave your estate to anyone and are fine with handing over your final affairs to a government agency.

Why do I need it?

The Family Emergency Binder fills a void in most estate plans. While many of us will already have a Will and other estate plans, they don’t include info for how to access our accounts or where to find these important documents.

The Family Emergency Binder completes your estate plan and will make things as easy as possible for your family when you’re gone. It’s a loving and selfless gift.

Why can’t I use a free legacy binder template?

You could, and I’d suggest that if this binder isn’t in the budget for you right now. The most important thing is that you get started and make your binder a reality!

But some of us don’t have the time to search the internet and cobble together a bunch of files to create one that suits us. The Family Emergency Binder has everything you need in one PDF (plus some thoughtful, unique extras).

It’s all laid out for you—all you have to do is go one page at a time and fill in the blanks. It’s also flexible; you can fill it out digitally or manually.

Finally, I’d argue that it’s worth paying for a well-designed PDF that’s easy on the eyes and easy to read. Those features may be hard to find in free templates.

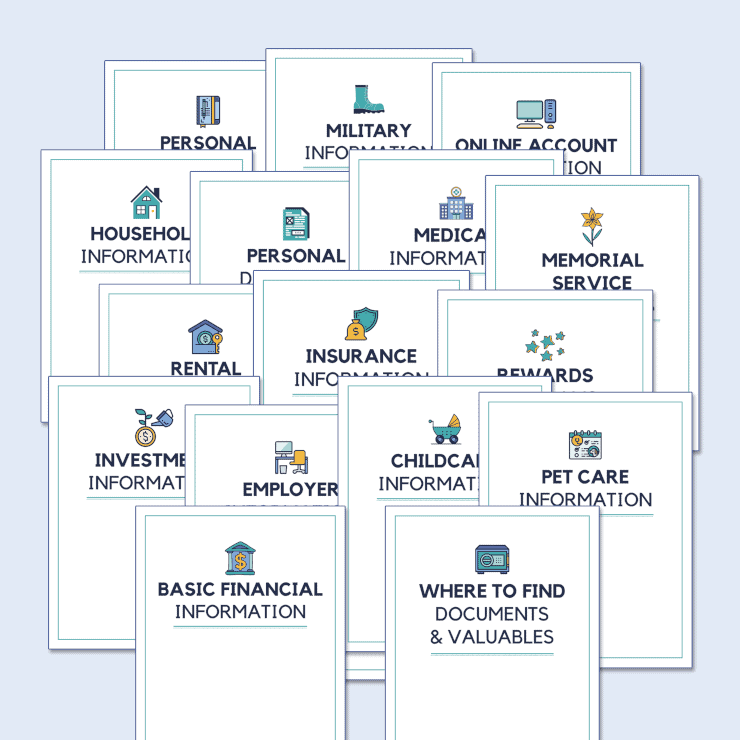

What’s included?

So much! Let’s go section-by-section through the PDF:

Household Information

This section is where you list the key contacts in your life so your family knows who to call for help. Making this info available can be helpful anytime, not just in emergencies.

You can leave copies of these sheets for babysitters, grandparents, or anyone else who may be caring for your kids, pets, or home.

Key Personal Documents

This is where you’ll include scans or photocopies of your government-issued ID and other key documents. (This will be so helpful for my family since I store these documents in multiple folders in our filing cabinet.)

Medical Information

This section includes:

- Info for your family’s medical insurance and pharmacies.

- Contact info for your family’s medical providers.

- Other medical info (allergies, medications, etc.)

- Medical power of attorney and living will templates.

Information for Non Parent Caregivers

This is my favourite section because it contains the info that will bring our kids the most comfort and normalcy during a challenging time in their lives.

I never thought to include important info like this, and I’m so glad that Chelsea didn’t overlook it:

- Forms to list important and helpful info for your children and pets’ care.

- A page to list your family traditions (I LOVE this).

Family Insurance Details

This section is invaluable. The info you include here will make it as easy as possible for your family to collect insurance payouts and cancel or transfer the policies for your:

- Home and auto insurance.

- Life insurance.

- Employer-provided insurance.

Basic Financial Information

If you’re like me, you’ve probably collected more bank accounts and credit cards than you care to admit! This section will help your loved ones to sort through the mess and includes info for your:

- Tax returns.

- Bills.

- Bank accounts.

- Credit cards.

- Debts.

Where to Find Original Documents, Keys, and More

This section is the key to all the other keys! Without it, your loved ones may not be able to start the important process of handling your estate. Make it as easy as possible on them by filling out this section so they can find your:

- Birth certificate.

- Will.

- Mortgage papers.

- Safety deposit box.

Employer Information

Your loved ones will likely need to contact your employer to let them know of your situation and get access to your benefits. This section includes pages for you to list this important info.

Military Information

If you’re a member of the military, this section is where you’ll list:

- Military-specific personal info (rank, date of exit, etc.)

- Military pay and benefits.

- Military burial wishes.

Social Media/Website Information

We’ve all heard how difficult it can be to access the social media accounts of the deceased. Help your loved ones to access your accounts so that they can notify your followers and close your accounts.

This section also includes a sub-section for those of us who are website owners. There are pages for you to list login info and social media accounts for your website.

Investment Information

This is the largest and most detailed section in the entire binder. It’s where you’ll include:

- Documents for all your investment holdings.

- Copies of agreements with your financial advisor.

- Lists of your monthly personal finance tasks.

- An outline of your investment strategy.

- An outline of your life insurance payout wishes.

- Info for your investment accounts.

- Info for your pensions.

- Info for your rental properties.

Burial/Memorial Service Preferences

While you won’t be there and it may not matter to you how your life is celebrated, your loved ones will appreciate knowing your wishes. This section is where you can let your family know how you’d like to be memorialized and how you’d like your remains to be handled.

This info is so important in the days immediately following your passing, but could easily be overlooked when estate planning.

Personal Notes

Grab your tissues—this is the section where you’ll write letters to your loved ones. Chelsea includes lots of writing prompts to help you leave a meaningful, treasured message for your family. Some of my favourite prompts include:

- My favourite memory of you as a baby.

- My dreams for you.

- I’ve always wanted to tell you…

- My best piece of advice for new parents is…

- My favourite family tradition I hope you’ll carry on is…

This is another favourite section of mine, and one that I’m almost certain is overlooked in other estate planning kits. While it’s a tough task to complete this section, I think it’ll be the most rewarding for you and your family.

Call Log

This will be incredibly helpful to your loved ones as they work through the process of settling your estate. Maintaining a call log can help everyone to quickly see who’s been contacted and which step they’re at in the contact process.

Extra Pages

This section includes blank note pages and duplicates of info pages from previous sections. You’ll also find blank note pages and duplicates info pages at the end of every section.

My final thoughts

Is the Family Emergency Binder worth it? The short answer is yes. At only $39 it’s so affordable and basically a no-brainer!

If it’s the thing that motivates you to finally collect your important info and get the ball rolling on your estate planning, it’s worth its price a thousand times over. And for the peace of mind it’ll give your family, I think it’s priceless.

This all-in-one PDF will make it as easy as possible for you to compile everything your family needs in an emergency. It’ll be organized, easy-to-read, and easy to access. Also, since it’s digitally fillable, you can update it and make multiple copies anytime.

Order your copy today, and give your family the loving, selfless gift of a well-thought-out emergency plan.

Order the Family Emergency Binder

Order your copy of the Family Emergency Binder for only $39! (Or, purchase the binder on a USB drive for $59.)

Prices shown are in US dollars.

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

2 Comments

Maggie

January 2, 2020 at 3:52 pmOoof that personal section hit me hard. I’m not a parent yet, but the number of bank accounts and cards I have makes me know it would be such a headache for my family to deal with if anything happened to me.

Another note: consider putting in passwords for tech devices. Unlocking a loved one’s iPad or phone can be nearly impossible without it.

Chrissy

January 2, 2020 at 11:10 pmMaggie: It sure makes it clear how complicated most of our financial lives are when we see it laid out like this! You are so right to suggest adding passwords for tech devices. Yikes, that’s a biggie for sure. Thanks for the wonderful comment.