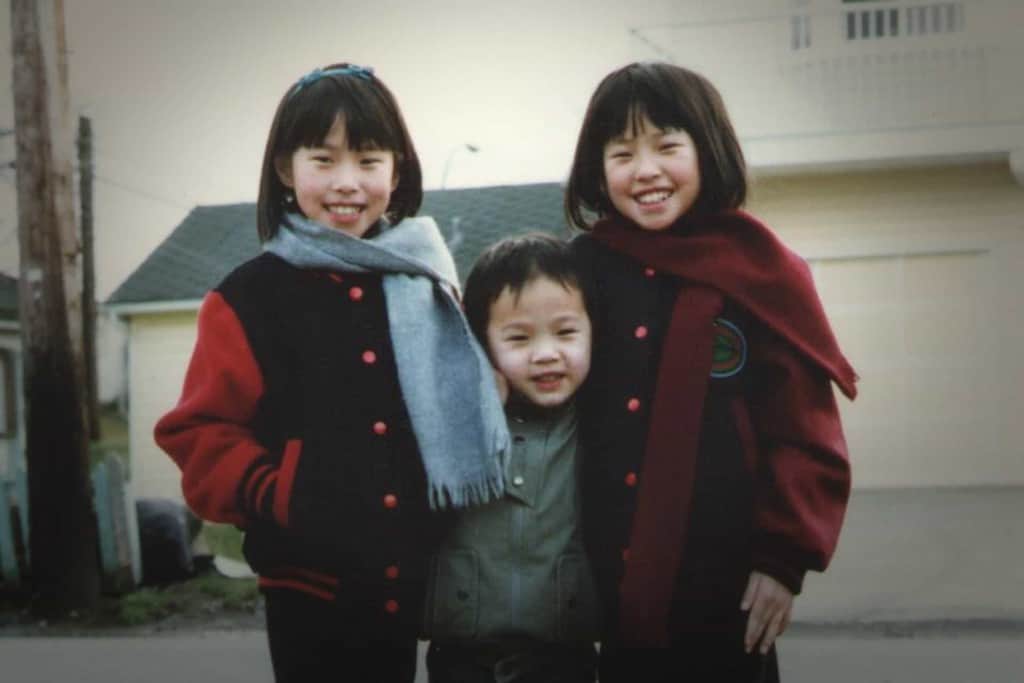

Our second birthday (I’m a twin—that’s me in the yellow hat!)

Frugal beginnings

My husband and I were raised by hard working parents who immigrated to Canada from Hong Kong in the 1960s. Our parents came with very little, and only had elementary and high school educations. None had the privilege of a post-secondary education.

What they did have was a strong desire to give their future children a better life. Through hard work, perseverance, and personal sacrifice, they gave us the comfortable, middle-class lives they dreamed we’d have. We can never thank them enough for all that they’ve done for us.

As I look back, I realize that my family lived like Mustachians long before Mustachianism existed. We didn’t take lavish vacations, trade up our house and cars every few years, or get all the latest toys and gadgets.

There were times when we envied the family who went to Disneyland every year or got a brand new minivan. But we had everything we needed and more: quality time with family and friends, home-cooked meals together, and a safe community to grow up in. These are the things that bring true happiness, and we had them in good supply.

My money education

We weren’t taught explicit money lessons growing up. There were no allowance systems, books, or podcasts to guide our parents. Instead, they instilled healthy money habits in us by setting a good example and discussing finances openly. We’re so grateful to them for putting us on the right path from the beginning.

My mom worked for a bank, so I naturally learned a lot about personal finance from her. When I turned 15, she gave me my first personal finance book: The Wealthy Barber. I read it cover to cover in just two days. I couldn’t wait to start “paying myself first”. All I needed was a job!

Luckily for me, I landed my first job that summer as a candy flosser at Playland (our local amusement park). I made minimum wage, which was only $6/hour—but it seemed like a million bucks to me! I saved nearly every penny I earned that summer and the next, and again at my next job as a Starbucks barista.

The art school years

I started art school in 1996, studying graphic design and illustration. At this point, I’d saved up more than enough to pay for my own books and art supplies. I offered to pay for my tuition as well, but my parents generously insisted on taking care of that. I was also able to live at home, which allowed me to quit my job at Starbucks and focus on the intense program I was enrolled in.

In the second semester, I got to know M, a funny and really nice guy in my class. I was shy, and resistant to his hints to call him, but he persisted and we eventually started dating.

M was raised very similarly to me. Frugality, hard work, and delayed gratification were things we both learned through our parents’ examples. From day one, our money beliefs were totally in sync. That’s played a huge role in where we are today.

M and I continued to be frugal through our three years in art school. While other students made their daily treks down to the cafeteria for coffee, snacks, and meals, we brown-bagged it.

Entertainment was rented movies at home. Eating out was an occasional treat. We lived like the poor students we were! But we were happy and content because we had everything we needed.

Getting the ball rolling

We graduated in 1999, and I quickly landed my dream job as a graphic designer at a local non-profit. The pay and benefits were low, but I loved the work and it was deeply satisfying.

M started with a job in the advertising department at a local company, but soon after accepted a position at a small video game company. That job eventually led him to his current position at a larger video game company.

Our first home

Despite our mediocre pay as rookie graphic designers, M and I saved every penny and were able to put 25% down on our first home. However, we’d be remiss if we didn’t mention that our parents played a large role in helping us save.

No, we’re not trust fund babies, nor did our parents have vast fortunes to shower upon us. They simply and slowly built our first nest eggs by tucking away all our birthday money, Chinese New Year lucky money, and government grants.

These little bits of money, carefully saved for 20+ years, formed about a third of our down payment. The powers of saving and compounding are truly amazing!

As we set up our home, we continued to follow in our parents’ footsteps, and lived frugally together from day one. We cooked most meals at home, shared one car, spent mindfully, and put everything else towards retirement savings and balloon payments for our mortgage.

Our wedding

After we bought the house, we saved up for another big goal—a wedding. Frugality continued to guide our decisions as we planned our wedding.

We did as much as we could ourselves, and searched for the best service providers at the best prices. We celebrated the day with 130 of our closest family and friends. It was a beautiful, memorable day that we were easily able to afford.

The crazy busy years

In the years to follow, we welcomed two baby boys into our lives, shifted to one income as I left the workforce, and started our house hack/side hustle of hosting students. Despite the decreased cash flow, we were still able to slowly build our savings due to our low cost of living.

Related: For many reasons, these years were very hard for us. I share more about this time in our life in this post.

The life-changing magic of the Mr. Money Mustache blog

Discovering Mr. Money Mustache

Life continued to hum along. We were on the classic middle-class treadmill: work, save, slowly build up a nest egg, then retire at 65. We assumed this was the only path a middle-class family like ours could travel. How wrong we were.

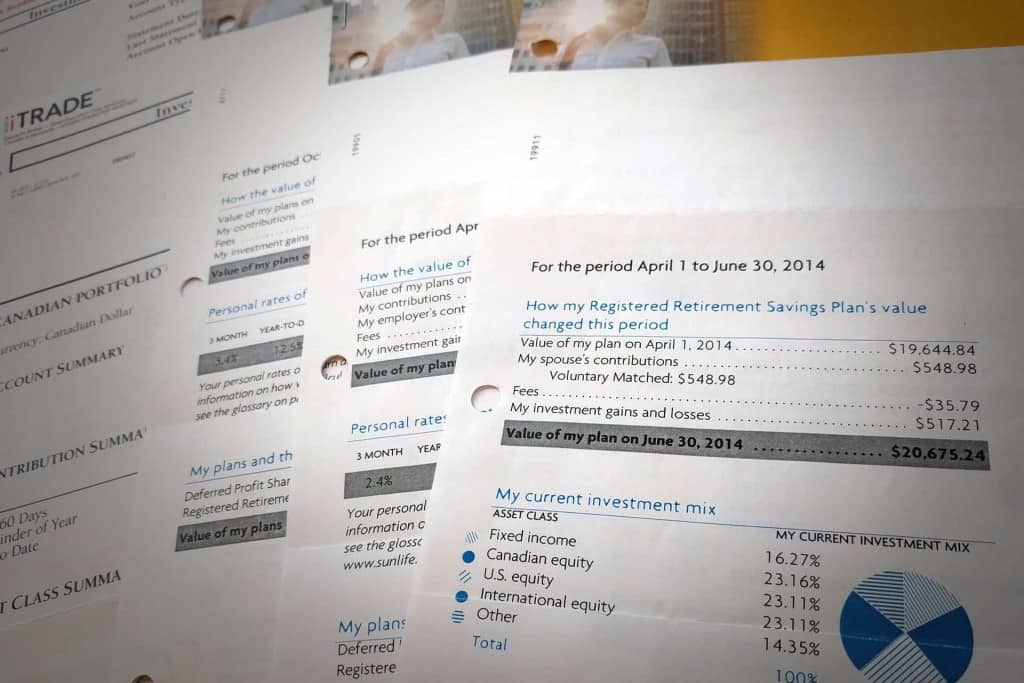

In 2014, the trajectory of our lives changed forever when I stumbled across Mr. Money Mustache. This smart, funny dude was telling us that we could retire in our 30s?!!! I truly felt like the prisoner in Plato’s allegory*, stepping out of the cave and into the bright sunshine.

*Read more about this at Jacked Finance (scroll to the Summary section to read about Plato’s cave).

MMM gave me a glimpse into an inspiring new world of extremely early retirement. It was not only within reach, but attainable in a much shorter timeframe than I thought possible.

Our FI journey begins

I was hooked on FI, and funnelled every last Netflix-watching, internet-surfing, time-wasting minute into pursuing financial independence.

I spent the next three years working hard at building my investment and personal finance skills, flexing my frugality muscles, and optimizing all our finances.

As 2017 rolled around, I finally had our savings and investments humming along nicely. Our path to financial independence was on track.

Eat Sleep Breathe FI

I finally felt ready to share our goal of FI with our families, and typed out a lengthy email to reveal my big plans. To my relief, our family’s response was overwhelmingly positive. Everyone was supportive and engaged, and open to learning more.

I started compiling lists of resources to share with them. As the lists grew, I wondered if there was a better way to share the info. I wanted to keep it updated and organized so our family could find what they needed. I also thought, “Wouldn’t it be nice if this info could help others too?”

Then it dawned on me—why not start a blog? And so I did, and here you are. 🙂

Related: The lists I made for my family eventually became FI School—a free ‘course’ to help you learn everything you need to know about FI (and FIRE).

We reached FIRE!

Seven years after I first discovered Mr. Money Mustache, we finally reached our goal—we reached FIRE in May 2021! I was 42 at the time and my husband was 45. For more details, I shared the whys behind my husband’s decision to retire in this post.

However, even thought we’re FIRE, I have no plans to quit blogging! I look forward to continuing to share updates on our post-FIRE life right here, along with my How Much Does it Cost to Live the FIRE Life interviews and other FI-focused content.

Introduce yourself!

I hope you enjoyed getting to know more about me. I’d love to learn more about you too! Feel free to comment below to say hello or share some of your backstory.

Even more about me and this blog

If you’d like to learn a little more about me and Eat Sleep Breathe FI, here are some links to help you do that:

- On my About Me page, you can learn more about me and my family.

- My Backstory will tell you even more about me, and how my husband and I started our money and FI journey. (I also talk about how the idea to start this blog came to be.)

- About This Blog explains how Eat Sleep Breathe FI adds diversity and a new perspective to the already-full FI blog scene.

- Here We Go is the first official post on Eat Sleep Breathe FI. It started as an explanation for my very long launch process, but in the end became kind of a blog manifesto. In the post, I talk about how I plan to blog and why I blog the way that I do.

- Episode 016B: Chrissy’s Backstory is an interview I did on my podcast, Explore FI Canada with my co-hosts Money Mechaninc and Ryan. I share my backstory, from my Mustachian upbringing to how I discovered FI.

- How to Reach FI on One Income, With Kids, in a High Cost of Living Area explains some of the many ways we’ve saved money and lived frugally.

- How Much Does it Cost to Live the FIRE Life in Vancouver? (As a Family of Four) is my interview with myself, in which I reveal our annual essential spending and even more ways we save money.

- We Did It—We Reached FIRE (Financial Independence, Retire Early)! is another interview with myself, in which I share when we reached FIRE and the whys behind my husband’s decision to retire at the age of 45.

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

16 Comments

Kristen Edens

January 8, 2019 at 8:53 amA great story, Chrissy! I enjoy reading everyone’s backstory and what led them to where they are now. It’s truly an adventure to hear how we move through life and how sometimes little and sometimes big things influence our direction. The exciting thing to consider is: our story doesn’t stop today. It continues to grow, evolve, and better us. I’m excited to read more of your story. 😀

Chrissy

January 8, 2019 at 9:32 amHi Kristen, I love reading anything that you have to say—whether through your blog, on Twitter, or in my comments! You have a way with words and are so good at seeing through the clutter. I look forward to getting to know you better as I begin my blogging adventures!

Kristen Edens

January 8, 2019 at 9:59 amThank you, Chrissy. As you have already discovered, I can be a bit effusive! Online that is–a comfort for introverts. It’s the stories that attract people and you’ll discover that many will be drawn to your story and experiences.

Chrissy

January 8, 2019 at 10:47 pmI agree—blogging is so much fun for me as an introvert! You’re also right about stories being attractive. I’ve enjoyed the stories you’ve shared on your site!

Frogdancer Jones

January 11, 2019 at 10:45 amWelcome to the blogosphere!

I also have boys, though I have a couple more than you do. Life’s never dull!

Chrissy

January 11, 2019 at 11:58 amIt really never is! You’re amazing to have single-handedly raised four boys AND reached FI at a relatively young age. An inspirational story for sure!

Baby Boomer Super Saver

January 13, 2019 at 7:40 pmLove your story & your writing style, Chrissy! I’m sure you’ll reach your goals quickly, as you have already proven you can set & reach goals successfully. “The Wealthy Barber” was one of the first financial books I read that really resonated with me, too. Another one was the original “Your Money Or Your Life”.

Chrissy

January 13, 2019 at 9:39 pmWow, you just put the biggest smile on my face. Such kind words—thank you!

I also read the original “Your Money or Your Life” and have been meaning to read the new reprint, but my library won’t order it for some reason! 😕 It may be one that I’ll need to bite the bullet and buy for myself!

Thanks again for your lovely comment.

Money Mechanic

January 14, 2019 at 8:39 amHi Chrissy, your backstory resonates with me. Mine is fairly similar, immigrant family growing up in the lower mainland. We never had much money, so frugality was the reality. I’ve spent my working life saving making sure I didn’t have to live with that money-related stress. MMM was a huge influence for me back in 2013. I crushed every post on his blog, and have never felt more motivated. Off I went down the FIRE blog/podcast rabbit hole… Along the way, I realized we needed more Canadian focused content for people seeking FI/RE. We recently started our own FI podcast, mainly aimed at Canadians. However, quality podcasting is HARD!! Of course, we have an accompanying blog and I’m enjoying the writing. Looking forward to following along with your blog. Oh, and by the way, awesome that you like driving stick-shift!! My wife and I agree completely.

Chrissy

January 14, 2019 at 9:04 amHi Money Mechanic,

My favorite part of blogging is that I get to converse with like-minded people—like you! I’m so excited to discover your blog and podcast (is it the first Canadian FIRE podcast?)

You’re absolutely right—more Canadian FI content is definitely needed. Really glad you’re in the community and putting out content.

Thanks for the great comment. You’ve definitely gained a new follower/listener in me!

Chrissy

Money Mechanic

January 14, 2019 at 9:15 amHey, I never actually considered we might be the first Canadian FI podcast!! We’ll have to have you on for an interview. We’re in Victoria if you want to add us to your regional list. I’m also super impressed you have 3 months of articles in the holster. FIgarage has 3 contributors and we don’t have anywhere near that yet!

Chrissy

January 14, 2019 at 1:23 pmI’m quite sure you’re the first! I listened to your intro episode, and love it already. You guys are pretty funny. Looking forward to more.

And of course I’d LOVE to be a guest. I’ll be a nervous wreck, and I don’t know the first thing about how to connect for a podcast interview (would it be over Skype)? But I’d love it nonetheless!

Carly

April 9, 2019 at 8:40 pmHi Chrissy,

Just checking out your blog for the first time, but I know I’ll be back. I introduced myself on the Choose FI Canada site and we already met there, but just wanted to say that I enjoyed listening to you on FI Garage’s podcast today and know that I’ll be avidly following along with both your blog and their podcasts in the future. I’m so into the Canadian FI experience.

I have two boys, too 🙂

Chrissy

April 10, 2019 at 7:21 pmHi Carly,

Wow, thanks for your kind words. You’ve made my day! I love connecting with other Canadians on the FI path, and I’m happy to have met you!

Thanks for taking the time to comment. 😊 I look forward to chatting more in the Choose FI group. And of course, feel free to contact me anytime if there’s anything I can help with!

Fringe Doc

October 22, 2019 at 12:45 pmInteresting back story. My wife (about your age) is from HK. Her parents came here with the children after Tiananmen. She speaks Cantonese and Mandarin fluently but has virtually no accent (came at the “right age,” I guess). She was one of maybe only 5 Orientals in my high school of 1200.

I was mildly surprised that your parents “let you” study art (instead of say, STEM), because of some of the cultural stereotypes I have become somewhat familiar with (I mean this respectfully and tongue-in-cheek). I jokingly accuse her of being a materialist / Capitalist, which isn’t really true (FI lifestyle is not popular in HK).

Chrissy

October 24, 2019 at 11:17 pmHi Fringe Doc, it’s nice to connect with you over here on my blog. It’s cool to hear that your wife comes from a similar background as me!

I agree that it’s surprising to hear of Asian parents who not only DON’T pressure their kids into STEM careers, but who “let them” pursue the arts.

My parents are just wonderful that way. They’ve always been very non-traditional and progressive (not just in how they raised us, but in their general world view). I love and respect them so much for that!

Thanks for stopping by to read and for leaving such an interesting and entertaining comment. 🙂