Photo credit: Marian Vejcik via Dreamstime

Roth IRAs, 401(k)s, 529 plans—oh my!

As a FI-curious Canadian, you’ve no doubt come across these distinctly American terms on your favourite FI blogs and podcasts.

Our southern neighbours have so many clever FI hacks to share… if only we could make sense of it all. (Then maybe we could figure out some Canadian analogues, and hack our own way to FI!)

Well, now there’s a resource that’ll help make things a little easier!

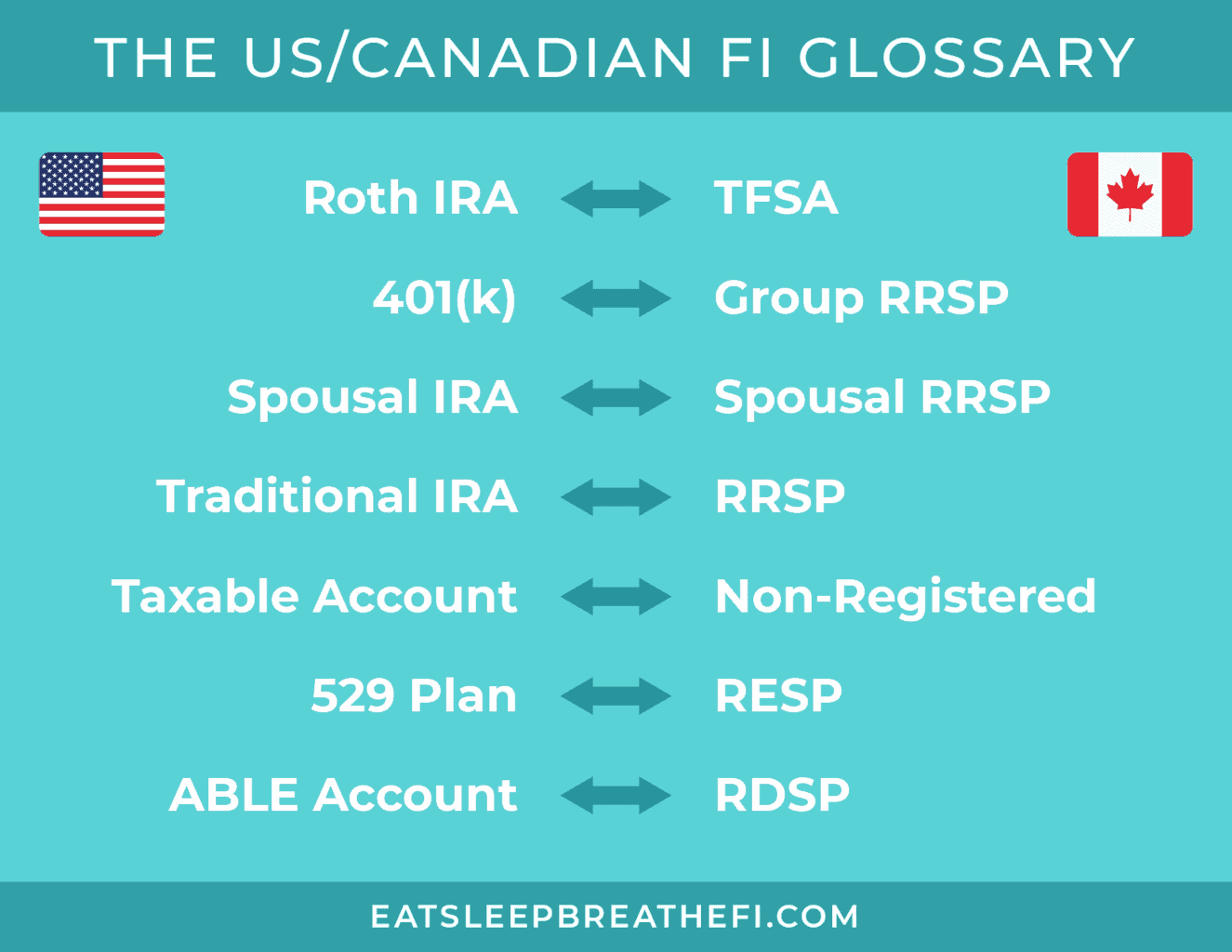

The US/Canadian FI Glossary

Finally—a resource to translate American FI terms into Canadian! The glossary below features a list of terms that are frequently used in the FI community. For each, a Canadian counterpart, similarities, and differences are listed.

The glossary is split into various categories (see the Table of Contents below). Click on the category name to navigate to it. Then, under each term, expand the tabs for more info.

Table of Contents

Click to jump to:

Glossary disclaimers

- This is not meant to be a complete guide to US/Canadian personal finance terms. It’s a brief overview of the major similarities and differences—from a FI perspective.

- For brevity and ease of use, I don’t include every possible account or term out there, nor all the minutiae behind each (e.g. age restrictions, specific limitations, etc.) Please do your own research to ensure you fully understand the details for your situation.

- This glossary is for general information only. Best efforts will be made to keep the glossary accurate and updated, but I cannot be held liable for errors and omissions.

Acknowledgement

Special thanks to my friend Court at Modern FImily. As a dual US-Canadian citizen, Court’s an expert at ‘translating’ American FI into Canadian!

She provided invaluable feedback on this glossary, including suggestions to add a number of terms that weren’t previously included. Thanks, Court!

Retirement accounts

Roth IRAs are most like

Roth IRAs are most like  TFSAs

TFSAs

- Contributions: Post-tax and not deductible.

- Taxation: Investments grow tax-free in the account.

- Contribution limits: The same (as of 2024): $7,000 (but see Differences section below for additional limits on Roth IRAs.)

- Withdrawals: Can be taken tax-free anytime (but see Differences section below for limits on Roth IRA earnings withdrawals).

- Unused contribution room: Unused Roth IRA contribution room is lost forever. Unused TFSA contribution room can be rolled over indefinitely.

- Contribution limits: Higher income individuals may not be eligible to contribute to a Roth IRA. Also, Roth IRA and Traditional IRA contribution limits are combined. TFSAs have no income limits, and contribution limits are not combined with other accounts.

- Recontributing: Once you withdraw from a Roth IRA, you lose that contribution room forever. TFSA withdrawals can be replaced—but you have to wait until the calendar year following your withdrawal.

- Withdrawal of earnings: Withdrawals from Roth IRA earnings may be penalized and/or taxed if you’re under 59 ½ or the account is less than five years old. Withdrawals from TFSAs are all the same—there’s no differentiation between earnings or contributions. There are also no age or time restrictions for TFSA withdrawals.

401(k)s are most like

401(k)s are most like  Group RRSPs

Group RRSPs

- Both are offered by employers.

- Contributions: Pre-tax and deductible.

- Taxation: Investments grow tax-free in the account.

- Withdrawals: Taxed as ordinary income.

- Recontributing: Not permitted—once you withdraw, you lose that contribution room forever.

- Employer match: Employers will often, but not always, make a matching contribution into the plan.

- Unused contribution room: Unused 401(k) contribution room is lost forever. Unused Group RRSP contribution room can be rolled over indefinitely.

- Contribution limits (as of 2024): For 401(k)s—$23,000. For RRSPs—18% of your income to a maximum of $31,560 (total combined with all other RRSP contributions).

- Early withdrawals: Generally, you’ll be penalized for early withdrawals from a 401(k). You’ll owe tax, but there’s no penalty for early withdrawals from Group RRSPs.

- Employer match: In 401(k)s, the employer match doesn’t count towards your contribution limit. In Group RRSPs, it does.

- 403(b)s, 457(b)s, and TSPs are cousins of the 401(k).

- Their limits and rules are very similar to 401(k)s, but they’re only for teachers and non-profit employees (403(b)s) state and local government employees (457(b)s), and federal government employees (TSPs).

- In Canada, there are only Group RRSPs—there are no organizationally-distinct accounts.

Spousal IRAs are most like

Spousal IRAs are most like  Spousal RRSPs

Spousal RRSPs

- Both are accounts where one spouse is the planholder, and the other is the contributor.

- Meant for couples where one spouse earns significantly higher income.

- Contributions: Pre-tax and deductible (for the contributing spouse).

- Taxation: Investments grow tax-free in the account.

- Withdrawals: Taxed as ordinary income (but see Differences section below for rules regarding withdrawal attribution).

- Recontributing: Not permitted—once you withdraw, you lose that contribution room forever.

- Unused contribution room: Unused Spousal IRA contribution room is lost forever. Unused SRRSP contribution room can be rolled over indefinitely.

- Contribution limits (as of 2024): For Spousal IRAs—$7,000. For SRRSPs—18% of your income to a maximum of $31,560 (total combined with all other RRSP contributions).

- Early withdrawals: Generally, you’ll be penalized for early withdrawals from a Spousal IRA. You’ll owe tax, but there’s no penalty for early withdrawals from SRRSPs.

- Withdrawal attribution: Spousal IRAs are always taxed under the planholder. SRRSP withdrawals are taxed under the planholder if no contribution has been made to any spousal RRSP in the year of withdrawal or the two preceding calendar years.

Traditional IRAs are most like

Traditional IRAs are most like  RRSPs

RRSPs

- Both are individual retirement savings plans.

- Contributions: Pre-tax and deductible.

- Taxation: Investments grow tax-free in the account.

- Withdrawals: Taxed as ordinary income.

- Recontributing: Not permitted—once you withdraw, you lose that contribution room forever.

- Unused contribution room: Unused Traditional IRA contribution room is lost forever. Unused Individual RRSP contribution room can be rolled over indefinitely.

- Contribution limits (as of 2024): For Traditional IRAs—$7,000 (total combined with Roth IRA contributions). For RRSPs—18% of your income to a maximum of $31,560 (total combined with all other RRSP contributions).

- Early withdrawals: For Traditional IRAs—generally, you’ll be penalized for early withdrawals. For RRSPs—you’ll be taxed, but there’s no penalty for early withdrawals.

US vs Canadian retirement accounts: three big differences

1. Income limits

In the US, some contributions are subject to income limits. (That is, if you earn over a certain amount, you cannot contribute to certain accounts.) In Canada, there are no such limits on any retirement account.

2. Unused contribution room

In the US, unused contribution room in tax-deferred accounts does not roll over indefinitely like it does in Canada. You have to use it each year or lose it forever.

3. Early withdrawals

In the US, penalties apply when withdrawing early from your retirement accounts. In Canada, there are no penalties or rules against early withdrawals.

Other accounts

529 Plans are most like

529 Plans are most like  RESPs

RESPs

- Both are education savings plans.

- Contributions: No annual contribution limits, but overall contribution limits apply.

- Taxation: Investments grow tax-free in the account.

- Replacement of withdrawals: Once you withdraw, you can never put the money back in.

- Overall contribution limits: For 529s—maximum contributions of $235,000 to $529,000 (varies by state). For RESPs—lifetime limit of $50,000.

- Government grants: Some states offer tax credits or deductions for 529 contributions. RESP contributions can receive a 20% government grant match, up to a maximum of $500/child/year, plus additional grants for low income families.

- Withdrawals: Some 529 withdrawals are tax-free, and some are taxed. RESP withdrawals are taxed at the student’s tax rate (which is usually 0% or close to it).

- Qualifying schools: 529 funds can be used for post-secondary, as well as elementary, middle, and high school. RESP funds can only be used for qualifying post-secondary schools.

- Qualifying expenses: 529 funds can be used for tuition and fees, but there are specific limitations for room and board, books, and computers. Generally, RESP funds can be used towards all education-related expenses (but there are limitations—please do your own research!)

ABLE Accounts are most like

ABLE Accounts are most like  RDSPs

RDSPs

- Both are long-term savings accounts meant to give individuals with disabilities extra financial stability.

- Contributions: Post-tax and non-deductible.

- Taxation: Investments grow tax-free in the account.

- Withdrawals: Tax-free and can be taken anytime (but if there are grants in the RDSP, some of that money must be repaid).

- Grants: There do not appear to be any government grants for ABLE Accounts. For RDSPs, account holders can apply for the Canada Disability Savings Grant (CDSG) and/or the Canada Disability Savings Bond (CDSB).

- Contribution limits (as of 2024): For ABLE Accounts—$18,000/year, with maximum account size at any one time of $550,000. For RDSPs—no annual limits, but a lifetime limit of $200,000.

- Withdrawal attribution: Withdrawals from ABLE Accounts are all the same—there is no differentiation between earnings or contributions. With DPSPs, contribution withdrawals are tax-free, but earnings and grant withdrawals are taxed under the planholder.

Taxable accounts are most like

Taxable accounts are most like  Non-registered accounts

Non-registered accounts

- Both are investment accounts which are not tax-sheltered.

- Investments in these accounts are made with after-tax money.

- In Canada, you may see both terms used interchangeably.

- Contributions: No annual contribution limits.

- Taxation: You’ll pay taxes every year on interest and dividends. Capital gains aren’t taxed until you sell.

- Withdrawals: No withdrawal limits or restrictions.

- Capital gains rate: In the US, capital gains may be taxed at short-term or long-term rates. In Canada, there is no differentiation.

- Calculating capital gains: In the US, you may use various methods to determine your cost basis to calculate capital gains: FIFO, LILO, average cost, etc. In Canada, only one method is allowed: average cost.

Government benefits

SSI is most like

SSI is most like  GIS

GIS

- SSI (Supplemental Security Income) and GIS (Guaranteed Income Supplement) are both government retirement benefits which are funded by tax dollars.

- Age of eligibility: 65

- Payments: Monthly.

- Taxation: Not taxable.

- Payments and income limits: These amounts vary depending on whether they’re for an individual or couple. The amounts for SSI and GIS also vary and change each year.

- Income eligiblity: For SSI—savings, investments, life insurance and assets are included as part of your “resources”. In addition, free food and shelter are included as part of your income (along with many other forms of income). For GIS—only income earned in the prior year is included. “Resources” are not considered.

Social security is most like

Social security is most like  CPP

CPP

- Both are government retirement benefits which are funded by payroll contributions.

- Payments: Monthly.

- Age of eligibility: For Social Security—62 for most people, but 60 if you’re a widow or widower. For CPP—60.

- Contributions: For Social Security—must have paid into the system for 10 years or more. For CPP—at least one contribtution.

- Taxation: For Social Security—15% is tax-free. The rest is taxed at your marginal tax rate. For CPP—the entire amount is taxed at your marginal tax rate.

Common terms

Expense Ratio (ER) is most like

Expense Ratio (ER) is most like  Management Expense Ratio (MER)

Management Expense Ratio (MER)

- Both terms refer to expenses which investments such as mutual funds and ETFs charge for administrative and other operating expenses.

- You may see the terms used interchangeably in both countries.

- None—they’re the same thing, just different wording.

RMDs are most like

RMDs are most like  RRIF minimum withdrawals

RRIF minimum withdrawals

- Both are government-enforced withdrawals from retirement accounts:

- RMDs (required minimum distributions) are withdrawn from qualified plans (e.g. 401(k), 403(b), traditional IRA).

- RRIF minimum withdrawals are withdrawn from RRSPs.

- Maximum age to start withdrawals: 72

- Maximum withdrawal amount: There is no maximum.

- Taxation: Withdrawals are fully taxed at your marginal tax rate.

- Calculation of annual withdrawal amount:

-

- For RMDs—divide the total balance of your qualified plans by the distribution period for your age.

- For RRIF withdrawals—an age-based percentage of your your total RRSP balances.

The S&P 500 is most like

The S&P 500 is most like  The TSX 60

The TSX 60

- Both are indexes that track the largest* public companies in their respective countries.

*Different criteria other than company size are also taken into consideration when a company is included in these indices.

- Number of companies: The S&P 500 tracks 500 companies whereas the TSX 60 tracks only 60.

- Largest company by market cap (as of January 2023): S&P 500—Apple at $2.27 trillion. TSX 60—Royal Bank at $137.8 billion CAD.

- Smallest company by market cap (as of January 2023): S&P 500—Under Armour, Inc. at $3.9 billion. TSX 60—SNC-Lavalin at $3.69 billion CAD.

Wash sales are most like

Wash sales are most like  Superficial losses

Superficial losses

- Both mean the same thing: selling a stock, then rebuying the same stock (or a substantially similar one) within 30 days before or after the sale.

- Both will disallow a capital loss deduction.

- None—they’re the same thing, just different wording.

Investments

CDs are most like

CDs are most like  GICs

GICs

- Both are savings certificates with a fixed maturity date and specified interest rate.

- Early withdrawals: Penalties apply.

- Interest: Taxed as regular income.

- Deposit insurance: CDs are insured by the FDIC up to $250,000 USD while GICs are insured by CDIC up to $100,000 CAD.

TIPs are most like

TIPs are most like  Real return bonds

Real return bonds

- Both are bonds that are indexed to inflation.

- They’re issued and backed by the government.

- Purchasing: TIPs can be purchased directly from the US Treasury. You can’t purchase real return bonds from the Canadian government.

Accounts and terms with no counterpart

American

American

- A complex strategy to convert a Traditional IRA (like a Canadian RRSP) to a Roth IRA (like a Canadian TFSA).

- Useful for high-income earners who’d otherwise be disqualified from Roth IRA contributions, and would prefer to pay taxes on the income now that so it’ll be tax-free later.

- FSA stands for Flexible Spending Account.

- Contributions are pre-tax, but not deductible.

- Funds can be used tax-free for health or dependent care.

- Funds must be used by the end of the year.

- HSA stands for Health Spending Account.

- Similar to FSAs, but contributions are deductible and the balance rolls over from year to year.

- Funds can be invested, and the growth is tax-free.

- Funds can be used tax-free for health care, and accumulated savings can be withdrawn tax-free after age 65.

- A strategy that uses the Backdoor Roth strategy to create a “ladder” of tax-free Roth IRA funds.

- The basic gist: you have to wait five years post-conversion to withdraw Roth IRA funds tax and penalty-free. If you do a Backdoor Roth conversion every year, after the first five years, you can withdraw some of it tax and penalty-free each year.

- SEP stands for Simplified Employee Pension.

- SEP IRAs are similar to Traditional IRAs, but they have higher contribution limits and are only available to small businesses and self-employed individuals.

- SIMPLE stands for Savings Incentive Match for emPLoyEes.

- SIMPLE IRAs are similar to 401Ks, but may be appealing to small businesses with 100 or fewer employees because they’re cheaper and less complex to administer.

Canadian

Canadian

- FHSA stands for First Home Savings Account.

- FHSAs are intended for first-time homeowners.

- You can contribute up to $8,000 per year—up to a lifetime maximum of $40,000.

- Contributions are tax-deductible and growth and withdrawals are tax-free (it’s like a combination of an RRSP and TFSA).

- There are other important details and rules regarding FHSAs, such as age limits. See this page on the Government of Canada website for more info.

- LIRA stands for Locked-In Retirement Account.

- LIRAs hold pension plan money you received from a company you no longer work for.

- You can’t withdraw from or contribute to LIRAs.

- When you reach age 55, you are allowed to convert your LIRA to a LIF—at which point you can start making withdrawals.

- OAS stands for Old Age Security.

- OAS is a taxable government retirement benefit that is taxpayer-funded and not affected by employment history.

- Seniors age 65 or older and who meet the eligibility requirements can receive the OAS.

- RRIF stands for Registered Retirement Income Fund.

- All RRSPs must be converted into RRIFs by the end of the year you turn 71.

- You can only withdraw from RRIFs—no contributions can be made.

What do you think of the glossary?

Feedback, edits, and suggestions are welcome, so share your thoughts on the glossary below! Also, feel free to link to, redistribute, or use the infographic. I’m happy for you to do that—as long as credit is given to Eat Sleep Breathe FI!

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

16 Comments

GYM

February 12, 2019 at 11:37 pmThis is lovely! Since blogging I have learned a lot of American terms, like 401Ks and 529 plans! We have a lot more similarities than differences, that’s for sure!

I think in Australia, they have a retirement plan called the “Super” and it sounds like our TFSA I think.

Chrissy

February 13, 2019 at 7:34 pmHey GYM—thanks for the comment! I’ve also heard of Supers, but don’t know much about them. I enjoy learning about FIRE in other countries, so I’ll definitely be reading up on those—just to indulge my insatiable curiosity/shiny object syndrome. 🙂

Reverse The Crush

February 20, 2019 at 4:09 pmWow, this is a great idea for a post, Chrissy! Thanks for putting this together! I have always had an idea of the US equivalent accounts but was not sure. Thanks again for adding me to your Canadian FI/RE Blogs list. Just so you know I added you to the RTC blogroll. I love what you’re doing. Keep it up! 🙂

Chrissy

February 20, 2019 at 5:57 pmHey RTC, thanks for all the kind words, and for adding me to your blogroll. It means so much to get encouragement from bloggers who are farther along than me. 🙂

Family Money Saver

September 14, 2020 at 9:36 pmThis post is a great idea for comparison of all the differences between CDN & US accounts. I didn’t know about RDSPs!

Chrissy

September 15, 2020 at 11:25 pmHi Family Money Saver—you’re very money-savvy, so I’m amazed that you learned something new from me! RDSPs are so great for the families who need it. I’m glad the Canadian government created it.

Shashi

February 17, 2021 at 10:13 amChrissy – this is a great resource and thanks for putting this together.

Regarding HSA, I believe there is a similar account in Canada but very limited in what we can do with it. At work, through the insurance provider, we have Health Care Spending Account (HCSA) and the $ amount in this account varies based on the plan we select. There is no individual contribution and you can carry over the balance for just one more year.

Chrissy

February 17, 2021 at 12:56 pmHi Shashi—I did debate about whether to include this since our HSAs are very different (it’s government-affiliated in the US, but only available privately in Canada).

However, you’re right, I should include them as they’re still somewhat analogous. I’ll make the update the next chance I have.

Steve @ The Frugal Expat

February 18, 2021 at 8:14 pmWow! This is an amazing glossary. I have quite a few Canadian friends, and trying to talk finances with them can get a bit confusing since we have different terms. This post alone helps educate myself on being able to communicate effectively with my Canadian friends. Thank you so much Chrissy.

Chrissy

February 18, 2021 at 9:26 pmHi Steve—it’s confusing for both sides of the border, ha ha. But once you learn the terminology, it’s not too bad! There are many similarities, which makes it easier to understand.

Thanks for reading and commenting, Steve. You’re a good friend for trying to understand Canadian accounts to help your friends!

Max @ Max Out of Pocket

February 28, 2021 at 7:30 amThis is really nice. I am US-based (New England) and generally live on the left side of your table, but that might change someday. My wife is Canadian (and Australian) and we have strongly considered moving back at some point. She just spent four months in Alberta learning to cut meat and would love to move home (Ontario) at some point. I will have a lot to learn about Canadian finance, but this table would help make it easy!

Poked around your blog this morning, I like it!

Take care,

Max

Chrissy

February 28, 2021 at 4:19 pmHi Max—this is such nice feedback to receive! You have an interesting mix of nationalities in your family. It sure makes your taxation education a little more interesting! I am fascinated that your wife learned how to cut meat. How cool! My husband does this just for fun, using YouTube. I’m sure your wife’s education was far more comprehensive, LOL.

Thanks for reading and commenting. If you one day do immigrate to the Great White North, be sure to check out my friend Court’s blog, Modern FImily. She’s a dual US/Canadian citizen and has mostly figured out how to deal with expat taxation issues. It’s not simple!

Impersonal Finances

March 2, 2021 at 4:24 pmThis is brilliant! I remember reading Wealthy Barber and wondering what RRSPs were equivalent to. What a great idea and awesome reference to have. So many great personal fire bloggers on both sides of the border, and finally there’s a translation guide available!

Chrissy

March 2, 2021 at 6:04 pmHi Impersonal Finance—I guess you read the Canadian version of the Wealthy Barber! I read an American version of the book not too long ago, and it was really odd for me, since I’d only ever read the Canadian version.

I used to find it really frustrating to hear about accounts which were foreign to me, but not knowing how to “translate” them. This was what drove me to create this translation guide.

It’s so nice to hear that it’s helpful to others! Thanks for reading and commenting. It means a lot. 🙂

Simpledar@Simpledar.com

January 19, 2023 at 2:13 pmThis is really helpful! As everyone, I follow many american blogs and I was always guessing what these accounts meant, but now I know where to find accurate information. Chrissy, you always bring the best information, Thank you

Chrissy

January 23, 2023 at 5:29 pmHi Simpledar—I’m happy to hear the post was helpful to you! I wish something like this existed when I first discovered FI. There was very little Canadian FI info at the time, so I had to figure out the translations with lots of research!