Photo by Gratisography on Pexels

Why another myth-busting post?

In Debunking FI/RE Myths, I listed eight widely-circulated FI myths and debunked each of them. That’s a lot of myths busted! So why am I feeling the need to revisit this topic?

Well, it’s because of a conversation I had on Twitter last week. It started innocently enough with this message I tweeted:

I truly believe our world would be happier and more sustainable if FI was considered 'normal'.

— Chrissy @ Eat Sleep Breathe FI 🍁 (@esb_fi) April 21, 2019

I'm on board with #425day and will write an article to commemorate it—what about you? Will you help spread the FIRE? 🔥

https://t.co/9JjNmJBaCQ via @GetRichQuickish

*For more about 425 Day, see: Happy 425 Day!

I was a little surprised to receive this reply:

Whenever I see statements like this I like to ask questions the get more clarity on the intent. What would FI being "normal" look like? Most people generally stop working at some point in the current state of things. Is that all it takes to be FI?

— The Financial Commoner (@thefincom) April 21, 2019

I replied with this:

Not at all! FI means being more mindful with our life choices and living a life of our choosing that's NOT determined by that mainstream society deems "normal".

— Chrissy @ Eat Sleep Breathe FI 🍁 (@esb_fi) April 21, 2019

It means not buying a bigger house than you need or always upgrading your car...

Not constantly upgrading everything in our lives without thought to why. It's being more thoughtful with all our spending so that we not only more sustainable with our spending but also with the planet...

— Chrissy @ Eat Sleep Breathe FI 🍁 (@esb_fi) April 21, 2019

THAT'S what leads to the freedom of FI. Then we can choose to do what we want with our lives. Usually, that means still working and being of value to the world. But then it's on our terms, not because we have no choice due to money constraints.

— Chrissy @ Eat Sleep Breathe FI 🍁 (@esb_fi) April 21, 2019

And that's why #425day's important

We exchanged a few more tweets, then The Financial Commoner came back with one last reply:

I struggle with what FI really means. Everyone needs money to live their life. It's just a matter or how much and where it's coming from. I guess my best definition of FI is that your financial status doesn't restrict your life choices.

— The Financial Commoner (@thefincom) April 21, 2019

And this is when I realized: the FI community still has a lot of work to do. We need to continue telling our stories so that others can understand FI more accurately.

**For the record: The Financial Commoner is not anti-FI. Rather, we’re in agreement that the definition of FI is vague and needs clarification.**

Debunking FI Myths: Volume 2

In Debunking FI/RE Myths, I quoted Paula Pant. It’s such a great quote that I’m posting it here again:

“… when I listen to the objections to FIRE, it becomes clear to me that the people who object to FIRE are ones who misunderstand it. I suppose as one of the voices out there who advocates for FIRE, I am partially responsible for that…

I know my mission now: I am going to keep advocating for FIRE… “

And so, I decided to continue fighting the good fight, and wrote another myth-busting post. Lucky for me, the internet’s filled with FI myths! It wasn’t hard to find a few to write about.

In this post, I’ll examine four myths: two longstanding ones, one that’s new (to me), and one that’s just… interesting. I’ll start with the most widespread and stubborn FI myth of all…

Myth #1: FI means never working again

Video credit: CNBC Make It

In this video, Kevin O’Leary (of Shark Tank fame) asserts that FI means never working again. This is the number one FI myth that mainstream media likes to circulate—and it needs to be laid to rest.

My response

Mr. O’Leary might be surprised to learn that we agree with him! He’s right—work isn’t bad, and there are benefits to it. But he’s got one thing wrong: stopping work isn’t what FI’s about.

FI isn’t about stopping work. It’s about having the time and money freedom to pursue what most fulfills us. (And more often than not, that’ll include some form of work.)

FI and ‘RE’ (retire early) are NOT mutually inclusive. They stand alone.

This is why I prefer to use the term FI rather than FIRE (scroll down to ‘FIRE vs. FI’). Adding the ‘RE’ into the mix just creates annoying videos like this.

Myth #2: FI requires extremism

Let's face it: 99% of us will never be truly financially independent. That's because it involves either FU money (via inheritance, prop trading or selling a company) or extreme frugality (like leaving your beloved city a la FIRE). So what options remain? https://t.co/nCkvanY70z

— Khe Hy (@khemaridh) April 22, 2019

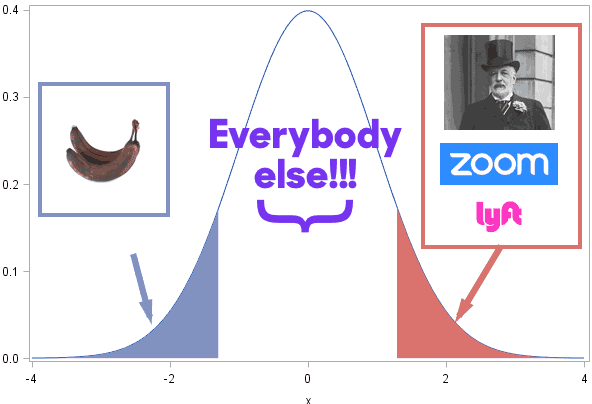

In the above tweet, Mr. Hy links to an article on his blog in which he claims you can only reach FI by going to extremes. He says you either have to buy brown bananas* or be a trust-fund baby or startup unicorn (see below graphic).

*The ‘brown bananas’ reference comes from this oft-quoted Wall Street Journal article. In it, a young lawyer named Sylvia mentions shopping for brown bananas as a way to save towards FI.

My response

Sure, there are extremists in the FI community. But the majority of us are the ‘Everybody else’ in Mr. Hy’s diagram. Spend some time in a FI Facebook group or forum and you’ll mostly come across ‘Everybody else’. We’re just a whole lotta normal, non-extreme people reaching for FI—on regular incomes.

My family falls squarely in the ‘Everybody else’ camp: we aren’t startup billionaires; don’t come from wealth; and brown bananas are just things we make smoothies with. We neither deprive ourselves nor do anything to the extreme. And yet, we’ll still reach FI in our 40s.

Hmmm… so sorry Mr. Hy, but ‘Everybody else’ would agree when I say: this myth’s been busted!

Myth #3: FI is unhealthy

I still think this is missing that FI isn't a good goal for most of us. It's really unhealthy.

— Dan Egan 🤓 (@daniel_egan) April 22, 2019

Okay, this was a new one for me. FI is now considered by some to be an unhealthy pursuit. Wha?!

My response

I’m not sure what Mr. Egan’s referring to when he says ‘unhealthy’. So I’ll try to get to the bottom of his point by examining three types of health:

Physical health

The FI community encourages and enjoys a variety of physical activities. We share healthy recipes to ensure we eat well, and we discuss the merits of getting enough sleep.

Conclusion: Hmmm… the FI community clearly gets a clean bill of health here. So maybe it’s our mental health that’s at risk? Let’s see…

Mental health

I hear over and over how FI-seekers became happier and more mindful after discovering FI. It’s no surprise; the FI community encourages happiness-increasing habits such as meditation, constant self-improvement, and lifelong learning. We also focus on decreasing stress and making lifestyle changes so that we can live our best lives now.

Conclusion: None of that sounds unhealthy to me. In fact, I’d say we’re above-average as far as awareness and proactivity in this area. So maybe Mr. Egan’s referring to our financial health?

Financial health

Debt is a clear sign of sub-par financial health. That’s why the FI community encourages doing away with debt as soon as possible. Once you get to zero, that’s when your financial independence clock starts. At this point, FI-seekers ensure good financial health by: saving emergency funds, spending below our means, earning more income, and wisely investing the difference.

Conclusion: FI-seekers take financial well-being to a whole other level! I’m again failing to see the unhealthiness of FI.

Well, we’ve covered three major aspects of health and can find no evidence of the supposed ‘unhealthiness’ of FI. In fact, it sounds like FI-seekers have the health and wellness game locked down!

Sorry Mr. Egan, but I gotta break it to you: this myth’s also been busted.

Myth #4: FI is a conspiracy theory

Gotta define FI first, and the milestones of it. Next have to cut out the scam industry built around it (bloggers/influencers) and then can have a good discussion about merits.

— Matthew Hague (@matthague1) April 22, 2019

Too much muck and lies living in that aspirational world. Strip them away and there's good goals.

I never saw this one coming: FI bloggers are lying scam artists? Let’s put on our tinfoil hats and take a closer look…

My response

Since discovering FI in 2014, I’ve followed countless FI bloggers and podcasters. I’ve taken their advice to heart and live in the ‘aspirational world’ they speak of.

Thanks to them, my family has never been happier, and our net worth has more than 5X’d. Oh, and we’ll also reach FI long before we hit our 60s.

Mr. Hague might be shocked to learn: the amount these bloggers have ‘scammed’ from me equals… exactly $0.

Maybe it’s the scam of selling a dream?

Okay, so maybe Mr. Hague isn’t referring to a financial scam. Maybe it’s the scam of selling an unattainable dream. If that’s the case:

- How have Phia and Mike been financially free since their early 30s—with two kids, living in high-cost Vancouver?

- How has Deanna been able to overcome addiction and six-figures of debt—yet still aim for FI in her 50s?

- How are Paige and Sam reaching FI while living in Los Angeles—on low and inconsistent incomes?

- How did Jillian reach FI in her early 30s with SIX children—despite growing up in poverty and only ever earning a below-average income?

I could keep going, but I think my point’s been made…

Sorry Mr. Hague—this FI myth’s also been busted!

A word to the naysayers

I’ll finish up this post with this: I’m more than happy to debate FI with others—even if we disagree. But what I’d like is for all the naysayers to come to the table having done some research first. (And by research, I don’t mean reading articles put out by mainstream media.)

Instead, read a variety of FI blogs (not just the popular ones). Listen to FI podcasts and get onto FI forums. Inform yourself and get to know what FI’s really about before you come out swingin’.

Summing it up

- There’s no shortage of FI myths floating around. (And they’ll very likely multiply as the FI movement grows.) It just means we need to keep sharing our stories and experiences.

- FI does not mean stopping work. It’s about having the time and money freedom to pursue what most fulfils us.

- FI doesn’t require extremism. Sure, go to extremes if that’s your jam. But if you’re scrimping and saving so hard that you’re miserable, you’re doing it wrong.

- Some may disagree, but the FI community encourages all kinds of health: physical, mental, and financial.

- FI bloggers and influencers are not out to scam you. Yes, some of them make good money off their blogs—but they’re the tiny minority. Additionally, all of them offer their wealth of knowledge for free. You can learn a lot from them without ever paying them a dime.

- If you’d like to debate FI with me or others, feel free! I just have one caveat: come educated. Silly, uninformed rants just waste everyone’s time.

Got somethin’ to say?

I’d love to hear it! Feel free to add your two cents in the comments below. I even welcome dissenting opinions. (Just keep it civil, ‘kay?)

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

14 Comments

Shaidah Karim

April 29, 2019 at 11:27 amGreat post Chrissy! Keep spreading the word and helping people understand what FI or FI/RE really is!

Chrissy

April 29, 2019 at 7:59 pmThanks Shaidah—you know I will!

PhiaFreedom101

April 29, 2019 at 7:33 pmAnother awesome post Chrissy! Love how you tackle these “objections” to FI! And thank you for the shout out as well 🙂

Chrissy

April 29, 2019 at 8:01 pmWell you and Mike have accomplished a lot at your young age—you’re living proof that FI principles work! Thanks for your kind words. 🙂

Savvy History

April 30, 2019 at 9:22 amVery insightful post with very relevant Twitter discussions! I agree with your reference to Paula Pant – Oftentimes, people who object to FIRE don’t understand it. For example, I’m not anywhere near it but still consider myself in this community. I see a retirement crisis coming in America, so I’m trying to be responsible, aim early (age 55ish), and hopefully, end up alright! I don’t see why anyone would object to this?!

Chrissy

May 1, 2019 at 8:03 amRight?! I also don’t understand all the FI-bashing. Even if you can’t retire in your 20s or 30s, the principles can help anyone improve their financial situation.

Money Mechanic

April 30, 2019 at 11:50 amYour word to the naysayers and your points in ‘Summing it up’ are spot on. If you’re going to debate, at least let’s have an educated debate. I think that many people are just caught up in a self-justification loop.

Chrissy

May 1, 2019 at 8:09 amSo true. I think people try to self-justify with FI in particular because it goes against what’s always been. It’s hard to look back on your choices and consider if they really were optimal. It takes courage to admit you might have been wrong!

Deanna

April 30, 2019 at 7:17 pmThank you for the mention, Chrissy! I am with you in that FI allows for more choices. Well we have a bit more work to do in defining it for the masses…

Chrissy

May 1, 2019 at 8:10 amLet’s keep working on that together! Thanks for coming by Deanna. 🙂

David S

May 1, 2019 at 2:10 pmGreat blog post, Chrissy. Keep busting those ridiculous myths!

Chrissy

May 1, 2019 at 2:34 pmThanks David—you know I will! 😉

Gina

May 1, 2019 at 7:49 pmYes!!!!! This post is amazing and so are you. I absolutely love how you are not only shutting down these myths but doing so with facts and passion. Great post, great perspective and great job!

Chrissy

May 1, 2019 at 8:21 pmWow Gina, you’ve made my day!!! Thanks for coming by and taking the time to leave such an awesome comment. 😀