The boys and I enjoying the beach in Victoria, BC (June 2010)

It’s hard to believe, but I’ve been a stay-at-home mom for over 13 years. That’s over a decade on a single full-time income… living in the most expensive city in Canada. And yet, we’ve lived a wonderful, full life… and are still on track to reach FI in our 40s.

How has this been possible?

In this post, I’ll outline exactly what we did. None of it requires luck or deprivation, and all of it is totally doable.

Note that this list only mentions the most significant money savers we implemented. We also saved money in smaller ways—similar to what’s listed in this article from Million Dollar Journey.

1. Buy a house with extra bedrooms—then put them to use

When shopping for our first home, our parents advised us to find one with a suite. This would give us the option to rent it out or host students as a ‘mortgage helper’. We’re so glad we listened!

While the simpler route would’ve been to rent out the suite to a tenant, we ultimately chose to host students. It gave us the potential to earn more money, and it was more flexible than renting to a long-term tenant.

When we moved to our second home, we again bought a house with extra bedrooms. (In fact, we moved with two students in-tow!)

Hosting students has been such an amazing life experience for us, and has turned out to be so much more than just a mortgage helper.

How much this saves us

These days, life is busier, so we only host students part-time. But in our younger, poorer years, we hosted students regularly and earned an average of $12,000/year. This extra income is what allowed me to stay home with our kids, and still have a tiny bit leftover to save.

Related: Homestay Hosting: All About the Money

Estimated savings: $12,000/year

2. DIY home improvements

Our first home was in original 1986 condition—well-maintained but SO dated! With the help of our families, we brought it into the new millennia by DIYing whatever we could:

- Painting walls, trim, and doors.

- Patching drywall holes (small and large).

- Spray painting brass hardware (to make it silver).

- Changing old-style beige outlets and face plates to modern white.

- Replacing toilets and toilet wax rings.

- Installing new light fixtures.

- Rewiring light switches and power outlets.

- Installing new bathroom and kitchen faucets.

- Tearing out and selling old kitchen cabinets.

- Installing a new dishwasher.

- Overhauling the weedy lawn.

- Building planter boxes.

For the things we couldn’t manage on our own (new kitchen cabinets, carpets, major plumbing) we shopped around. But we didn’t just look for the best price—we made our decisions based on what was the best value.

Plus, to get even more bang for our buck, we’d observe the contractors as they worked so we could learn from their techniques.

When we moved into our second house, we didn’t need to do any updating since it was much newer. But we’ve continued to DIY regular maintenance and improvements:

- Added an extra bedroom in the basement (with lots of help from two uncles).

- Put in a home theatre.

- Touched up paint.

- Repaired and replaced fence panels.

- Rehung sagging gates.

- Repaired leaky faucets.

- Recaulked sinks, showers, and tubs.

How much this saved us

I’d estimate the DIYing in our first house saved us (conservatively) $20,000 in labour costs. In our second house, we’ve saved at least $10,000.

Estimated savings: $30,000+ over 18 years of home ownership

3. One car for as long as possible

Before Kid 1 came along, my husband M and I shared one car and carpooled most of the way to work. He’d drop me off at a SkyTrain station, then drive to work where his parking was free. I’d continue on by public transit since my workplace was easy to access by SkyTrain.

Going home, we’d repeat the routine in reverse. It wasn’t always easy to sync up our work schedules to make carpooling possible, but our flexibility led to big savings!

When Kid 1 was born, M transferred to an office downtown and was able to commute there by bus—so we still only needed one car.

Later on, M transferred back to his original office and needed a car again. At this time, we were fortunate to have been able to borrow an elderly relative’s Toyota Camry.

It wasn’t until Kid 2 came along that we finally bought a second car (with cash—naturally!)

How much this saved us

We were able to avoid purchasing a second car for eight years. This allowed us to put more money towards our mortgage and cash savings for our eventual second car. It also gave us enough of a cash cushion to transition from two incomes to one.

Estimated savings: Thousands in mortgage and car loan interest

4. Cook at home—a lot!

We both grew up in households where daily home-cooked meals were the norm, and eating out was a rare treat. This was all we knew—so when we moved out, we carried on the same way.

However, while we both knew how to cook, it’s a different ballgame when you also need to plan meals, buy groceries, and manage your food inventory! It took some trial and error, but we never gave up. From day one, we’ve managed to cook 99% of our meals at home.

How much this saves us

After tax and tip, an average restaurant meal for a family of four costs about $80. If we were to eat out twice a week, that would equal $160 per week. In a month, that adds up to $640. In a year, that’s $7,680!

Estimated savings: $640/month or $7,680/year

5. Meal plan around sales

This was something we weren’t great at in the beginning. Our cooking repertoire wasn’t huge, so we didn’t cook based on sales. Instead, we bought based on what we knew how to cook!

This often meant buying meat and produce at full-price. Luckily, by the time we had kids, we mostly had this game figured out. We now have a big enough archive of go-to recipes that we can take just about any sale item and turn it into a yummy dish.

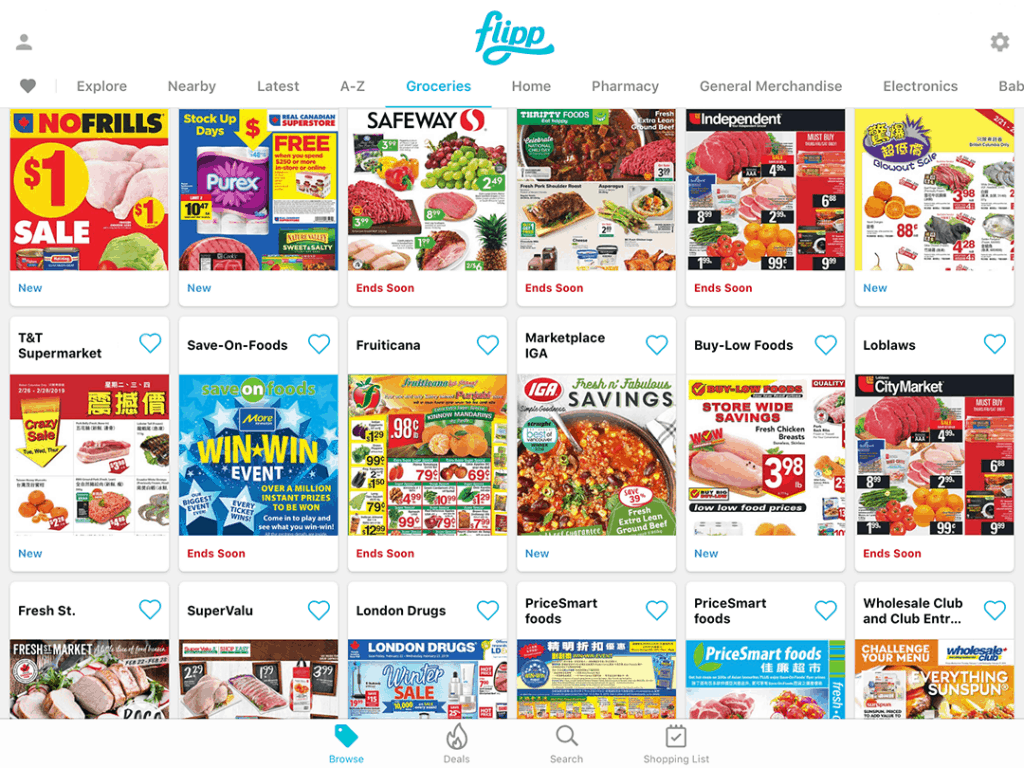

Note: Flipp has significantly improved our grocery sale game. Not only do we get the convenience of digitally accessing our flyers, but it saves a lot of paper. (We requested that printed flyers not be delivered to us anymore.)

How much this saves us

As an example, 4 lbs of chicken legs would cost $3.99/lb at regular price (total: $15.96). If purchased on sale for $1.89/lb (total: $7.56) that saves us $8.40.

If we were to extrapolate those savings across an entire week, that’s close to $60/week saved. For a month, that would be $640; for a year—$7,680!

Estimated savings: $640/month or $7,680/year

6. Buy a stand-alone freezer

I never realized how much we needed a stand-alone freezer until we got one. Here’s why we love it:

- We can buy in bulk when things are on sale, and freeze the extras.

- We can ‘shop’ from our freezer if in need of an ingredient that’s not on sale.

- We can freeze anything we can’t eat in time (less food waste, and easy meals for later).

- We can freeze ready-made meals for busy evenings (no need to resort to takeout).

- We can bulk-cook staples like soup stocks and beans then freeze them for future use.

How much this saves us

If we were to buy a non-sale meat item once per week that would cost around $8 extra. Eating out once per week because we didn’t have time to cook would cost $80 extra. Throwing out expired food might equal $20/week. The total for one week would be $108. That’s $432/month or $5,184/year!

Estimated savings: $432/month or $5,184/year

7. Brown-bag (or Pyrex) it

On top of cooking breakfast and dinner at home, we also cook enough to have leftovers for M to take to work the next day. Not only is this cheaper and healthier than going out for lunch every day, but it also makes for zero-waste lunches.

How much this saves us

After tax and tip, an average restaurant lunch costs about $15. If M was to eat lunch out every workday, that would equal $75/week. In a month, that adds up to $300. In a year, that’s $3,600.

Estimated savings: $300/month or $3,600/year (for one person)

8. Shop at discount grocers

We live in a high-income neighbourhood. Most people here turn their nose up at shopping at our favourite discount grocer: Real Canadian Superstore. I get it—the customer service leaves a lot to be desired, and it’s not exactly fun to shop in a huge, crowded store.

But their prices are consistently, significantly lower than other stores. It just doesn’t make sense to do the bulk of our grocery shopping anywhere else!

A friend once mentioned that their grocery bill was over $1,000/month for their family of four. They don’t shop at Superstore. We average $550*/month for our family of four. When we host students, we still come in under $1,000—at around $800/month.

Hmmm… I think we’ll stick to shopping at Superstore!

*Our grocery bill is actually lower than this. When we buy personal care, household, and cleaning supplies from grocery stores, they get lumped into the groceries line item.

To save even more money, we also:

- Take advantage of PC Optimum Points (Superstore’s points program). Each year, we earn and redeem $150–$200 in points by buying things we’d buy anyway.

- Earn the higher 4% grocery store rate from our cashback card by buying our personal care items, electronics, and household and cleaning supplies at Superstore.

- Shop at other stores for loss leader sale items (if it’s on our way). Otherwise, we pull up the competitor’s flyer in Flipp, then show it to the cashier at Superstore to match the price.

- Shop at ethnic grocery stores—their meats and produce tend to be extremely fresh and well-priced.

- Ask M’s mom to help us pick up things from Costco when she goes (we cancelled our membership this year).

- For even more tips on saving money on groceries, check out this helpful post from fellow Canadian blogger Bella Wanana.

Estimated savings: $450/month or $5,400/year

9. Travel with family

We LOVE to travel, and we love spending time with our families. It’s just a bonus that combining these things also saves us money. Here’s how:

- We book accommodations through Airbnb or VRBO. (This doesn’t necessarily save us money, but we get a larger, nicer place for the same per-person cost.)

- We split up cooking duties so it’s not a burden for anyone. (This allows us to cook more and eat out less.)

- We meal plan together so we can overlap some ingredients and buy in bulk.

- We share the cost of rental vehicles, Ubers, or taxis.

- If we’re going on a road trip, some of us can carpool to save on gas and parking.

- We share the load when researching accommodations and activities. (With multiple people on the hunt, this means we’re more likely to catch good deals!)

- We purchase attraction tickets with a family or group rate.

- Some of us are seniors and can access discounts that benefit all of us. (For example, for an RV campsite.)

How much this saves us

Accommodations

While we typically don’t save money by booking as a larger group, we do get nicer, larger accommodations for the same per person price.

Food

When we travel with our families, we always cook our breakfasts and dinners (and some lunches). If an average breakfast costs $60 for our family of four, and the average dinner costs $80, that’s $420 saved over a long weekend or $1,960 for a two-week vacation (wow)!

Transportation

An economy compact costs $525/two weeks—$131/person if travelling as a family of four. A family van costs $625/two weeks—$104/person if travelling as a group of six. That’s a $27/person savings. For our family of four, we’d save $108 for a two-week vacation.

Attractions

A typical family or group rate saves about $5/person. If we visited two attractions on a two-week trip, that would save our family of four $40.

Estimated savings: $2,108 (for a typical two-week vacation)

10. Hand-me-downs and second-hand goods

When M and I furnished our first home, we bought a new bed—but that was pretty much it! Just about everything else was hand-me-downs or garage sale finds. We’ve since upgraded our furnishings (but many of those upgrades were still hand-me-downs/second-hand.)

When kids came along, we continued to be lucky with hand-me-downs of baby gear, toys, clothing, and books. As for sports gear, second-hand works best for us (adult stuff too!) Some sports equipment (ahem—ice hockey and skiing) could easily cost hundreds brand-new, but instead cost under $100 used.

We’re also lucky to be able to pass most things down from Kid 1 to Kid 2—double the use for the same price!

Other things we try to buy second-hand include:

- Cell phones

- Housewares

- Halloween costumes

- Video and board games

- Clothing

- Tools

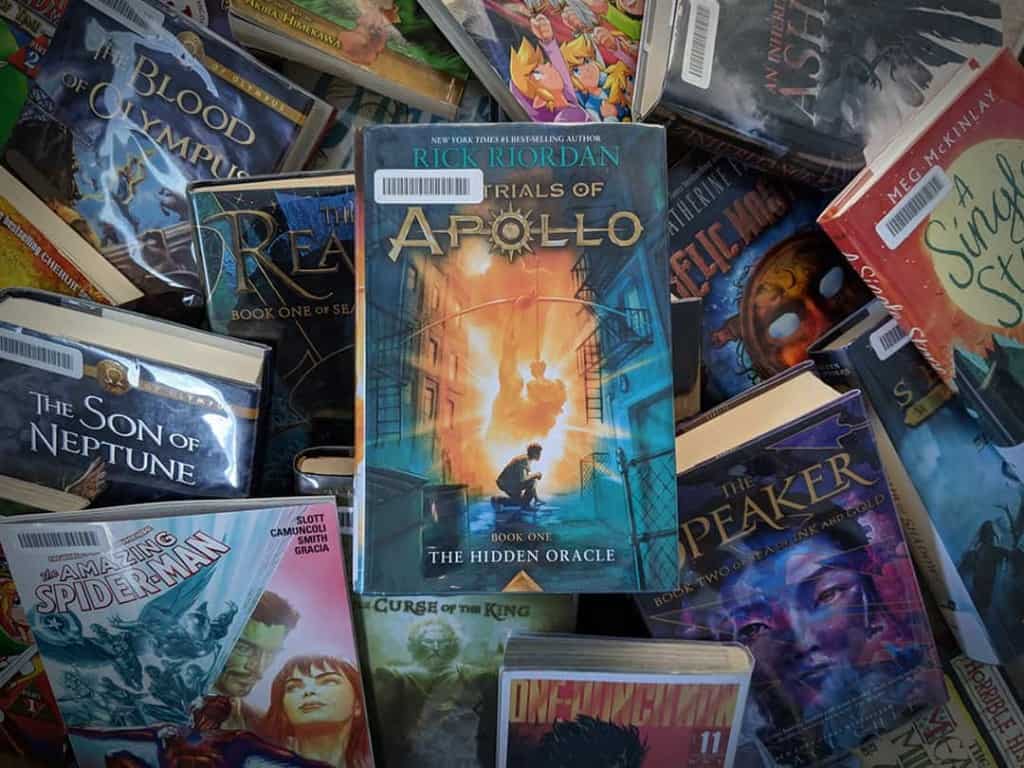

- Books (but we mostly borrow them for free from the library)

Estimated savings: $1,000+ per year

11. Use the library

I LOVE libraries! (So much that I plan to write an entire post about why I love them so much.) For this article, I’m focusing on how they save us money.

The obvious way is that they do away with our need to buy books. Seriously—if we had to buy all the books our kids read, we’d easily be out several thousand a year. (Yes, they read that much!)

And that’s not even counting the books my husband and I read, or all the e-books and audiobooks I borrow through Hoopla and Libby.

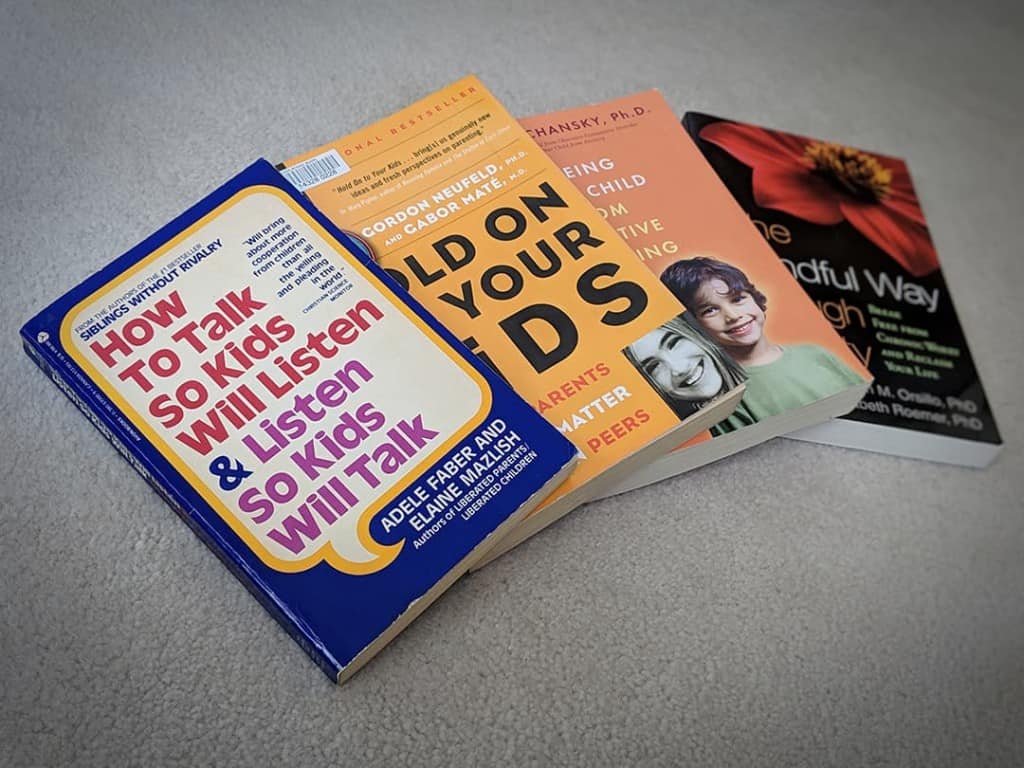

There’s also a less-obvious way that libraries save us money: through education. I’ve lost track of how many money-saving skills I’ve learned through library books.

Additionally, my kids have enjoyed robotics, programming, and writing workshops—all free, courtesy of our local libraries.

Estimated savings: Thousands of dollars per year

12. Take advantage of free and low-cost entertainment

We rarely buy expensive tickets to concerts, games, and events—yet we don’t feel any less cultured or that we’re missing out on fun. I’m always on the lookout for free and low-cost entertainment, and have managed to keep my family happy and entertained year-round.

On an entertainment budget of around $150/month, we’re able to:

- Watch a movie at the theatre every couple of months (with an occasional $10 large popcorn).

- Have a fun, family activity to go to every single day in the summer, and every single weekend during the school year (we love you, Kidsworld!)

- Visit just about any local attraction for free or at a discount (through Kidsworld, M’s corporate discounts, and other promotions).

- Ski, snowshoe, skate, zip line, toboggan, and watch live entertainment on a local mountain using our discounted season’s pass.

- Attend amazing, life-changing events like WE Day Family Vancouver for FREE.

- Go to local festivals, night markets, and community events.

- Read as many books as we want (free from the library).

- Play videogames for free (from the library and the lending library at M’s work).

Related: In Mustachianism Got You Down? read about all the ways we save money on entertainment costs. (Scroll down to the ‘Entertainment’ section.)

Estimated savings: $1,000+ per year

13. DIY classes and lessons

Classes and lessons are one area where parents can easily spend a fortune. But it doesn’t have to be this way!

Before registering for classes or lessons, we always try to do them for free or cheap at home first. If we find we need more advanced instruction, we can then register for professional lessons.

Here are some of the at-home lessons we’ve had success with:

For kids

- Splash Math—$24 (Private tutoring: $300/school term)

- Typing Instructor for Kids* (Private lessons: $600)

- Smiling Mind—FREE (Group counselling session: $480)

- Scratch—FREE (Summer programming camp: $350)

- Skiing lessons taught by my husband—FREE (Ski camp: $380)

For adults

- Justin Guitar—FREE (Private guitar lessons: $200/month)

- Insight Timer meditation app—FREE (Community centre class: $15/session)

- Lynda.com—FREE through our library (Paid Lynda.com plan: $31/month)

- YouTube—FREE (Basic woodworking community centre class: $365)

- Yoga DVDs—$60 (Community centre yoga classes: $55/month)

Estimated savings: Thousands per year

14. Take community centre or library classes

Some things just can’t be taught at home. When this is the case, we first look to see if the activity’s offered at our local community centres or libraries. Often, the instruction is just as high-quality, but the cost is significantly less than classes offered privately.

Once we’ve tried the cheaper class, and we’re sure that we or our kids want to pursue the activity further, we then decide if it’s worth paying the higher price for private classes.

Here are some community centre and library classes our kids have enjoyed:

- Ice hockey

- Floor hockey

- Soccer

- Swimming

- Climbing

- Badminton

- Karate

- Tae Kwon Do

- Robotics

- Programming

- Writing

- Comic book illustration

Estimated savings: $200+ per month

15. Work on self-improvement

Many people assume that as a stay-at-home mom, I’m just a lady of leisure. They think I spend my days watching soap operas, drinking coffee with other moms, or shopping.

The reality? Whether it’s during the day or in the evening, I rarely watch TV and movies. Coffee dates with friends are only an occasional treat. And as for shopping? Well, I’m a FI-seeker now—I just don’t enjoy shopping for leisure anymore.

So what do I do with my days?

Besides dealing with the endless daily chores of life, I use much of my alone time to work on improving myself. Self-improvement makes me a better, happier version of myself AND saves us a whole lot of money and heartache.

How self-improvement saves money

When we’re unhappy and stressed, we have less time and energy to do things for ourselves. This leads to spending on conveniences and quick fixes.

It can also require professional help, and sometimes—medication. All of this doesn’t come cheap. This additional spending compounds our stress, which leads to more spending.

This is why I believe so strongly that all of us need to prioritize constant self-improvement.

Ways I’ve worked on self-improvement

Through library books, apps, podcasts, and professional help, I’ve:

- Healed my postpartum depression and anxiety.

- Grown my skills as a parent.

- Learned how to help my kids cope with challenges.

- Expanded my personal finance and investing knowledge.

- Taught myself to DIY invest.

- Learned how to blog.

- Become a better writer.

I plan to share more about my self-improvement journey in the future. For now, if you have any questions or would like to know more, feel free to ask in the comments below.

Estimated savings: Thousands per year

16. Let go

When we first moved into the beautiful higher-income neighbourhood we live in, I put a lot of pressure on myself to keep up. Most of our neighbours have magazine-worthy homes and manicured lawns and gardens.

Thankfully, I found FI—and that self-imposed pressure has almost completely melted away. Since discovering the bigger life goal of FI, keeping up with others has fallen right off the list of things I care about.

Here are some things I’ve let go of, and now choose to spend less (or no) money on:

- Trendy new home furnishings and decor.

- Constantly updating said home furnishings and decor.

- Trendy new clothes—for myself and the kids.

- Constantly updating said clothing (except to replace worn or outgrown items).

- High-end summer camps for the kids (but if they asked, I’d consider it).

- High-end lessons for the kids (but if they asked or it was needed, I’d consider it).

- Perfect landscaping.

- Luxury, high-end vacations.

- A trendy mom-mobile—aka an SUV. (I drive a boring, practical Mazda 5.)

Estimated savings: Tens of thousands per year

Conclusion

- It’s hard for non-FIRE folks to understand how we’ve been able to live for so many years on one income. But the truth is—none of the things we’ve done are out of reach.

- All of us can make choices (both big and small) to improve our financial situation and move closer to the life of our choosing.

- We’re a regular family. We just made small tweaks to the standard North American middle-class lifestyle. This is what allowed one of us to be at home with the kids, and still get to FI.

- If anything in our journey resonates with you, consider making some similar changes in your life. Take one step each day to improve your finances. Over the course of a year, you’ll make enormous progress.

Share your tips!

How have you saved money so that you can still reach FI—despite a decreased income, having kids, or a high cost of living? Share in the comments below!

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

26 Comments

PhiaFreedom101

April 8, 2019 at 7:06 pmYes, yes, and yes! I love (and relate) to every single one of these points Chrissy! Combined, they make for massive savings that truly do expedite the path to FI (even for us high cost of living people!) This is a fantastic article! I also completely agree with your comments regarding self-improvement. I think that this can often be an undervalued area that doesn’t get the recognition it deserves for how much it can move the financial needle.

Chrissy

April 10, 2019 at 7:27 pmI love that we see eye-to-eye on so many things Phia. Could you be my long-lost triplet? (I’d say twin, but I already have one!) LOL

I take it as a huge compliment that you’ve done many of the same things in your journey to financial freedom. You and Mike have clearly done a lot of things right to have reached freedom as early as you have.

Thank you for such a lovely comment. It made me smile to read it!

PFI

April 9, 2019 at 5:47 amThis is a great post with specific examples! I especially appreciate the recognition of the library not just for books but also for the activities they offer. I was a heavy consumer of those as a kid and have lots of great memories.

Good luck on the journey – you seem to have it dialed in!

Chrissy

April 10, 2019 at 7:31 pmHi PFI! So nice of you to stop by and leave a comment. 🙂 I love meeting other library fans. (Seems there are lots of us in the FI community—I don’t think that’s a coincidence!)

Kris

April 9, 2019 at 3:52 pmGreat post Chrissy!! I could relate to most of these ways to save money and be on the path to FI. Being an avid reader on self-improvement books lately, you can grow your skills and expand your way of thinking. It can give you more confidence on yourself. It just a great feeling to learn ways to improve yourself.

We also meal plan around sales, particularly for Costco. I have the Costco app and look forward to what they save on sale for the next month. This way we know what we’re going to eat on most weeks during that month.

I also like that you made great use of the extra bedrooms on your home by hosting students. You got extra income and developed lifelong relationships with the students.

I could go on with the other ways you saved money but I really like you and your family and so focused on the FI journey especially living in an expensive area like Vancouver. I could relate by living in SF and how expensive it is over here as well.

Chrissy

April 10, 2019 at 7:39 pmHi Kris,

HCOL city dwellers unite! We’ve gotta do everything we can to swap tips and support each other!

I love that you and others on the FI path save money in similar ways. I don’t see a lot of these habits in my neighbors, which is too bad. Most of them are higher income than us, so it wouldn’t be hard for them to reach FI if they implemented just a few of these savings habits.

Thanks for taking the time to write such a thoughtful comment. 🙂

R!CC

April 11, 2019 at 7:28 amYour student bedroom looks an awful lot like my guest room. I had 3 solid years to rent that out and now its too late since my children are taking it over. Missed opportunity.

Chrissy

April 11, 2019 at 7:56 amWe’ve gone part-time with our hosting… so lately, that bedroom’s empty more often than it is full!

But we all just do our best at any given time. That’s what counts, right?

Sam

April 12, 2019 at 11:42 amChrissy, so many good ideas and some particularly close to my heart – self-improvement books and using the library. New to me was the idea of meal planning around the food sales. We are a pescatarian household, although recently have been eating mostly vegetarian. Vegetables are cheap, but buying fish when it is on offer is a good idea, as well as other groceries. Finally, I loved the fact that you said that you dog sit. My partner and I love dogs, but due to our working patterns don’t feel that it would be fair to have one full time. We volunteer for a charity who train assistance dogs and care for different trainee dogs several times a year. We love each and every one of them. They are usually Labradors or retrievers and always so good natured. Thanks for a great post as always. Sam

Chrissy

April 12, 2019 at 9:13 pmI’ve ALWAYS wanted to volunteer with assistance dogs! I love that you volunteer for a charity that does that.

We’ve never been able to commit to taking one of these puppies in as it’s quite a huge commitment. But I didn’t realize you could just care for these dogs occasionally.

That might actually be a good option us! I’ll have to look into that. Once again, thanks for commenting. 🙂

Abigail @ipickuppennies

April 20, 2019 at 11:16 amPhew, that’s a lot of savings! I wish my library had as many cool-sounding classes as yours does, though I should investigate it a bit more as to what it actually offers. I know it’s not nearly as comprehensive (and I live in Phoenix, a relatively major metropolis). That said, it does have culture passes, which is cool. It’s free passes to get into some local attractions, like the science museum, botanical gardens, etc. I keep meaning to take advantage of that at some point but never seem to get around to it. Guess I’ll have to work on that.

Grocery savings can definitely be huge, especially when it means you’re cooking at home a lot. I don’t cook, which is a major frugality faux pas, but I do keep costs relatively low with the food I do buy (my frozen meals are only $2.79 — or less when on sale, which is frequently, the protein bars are $1, etc.) So I’m not breaking the bank with this bad habit. Still, I could probably save $50ish a month if I sucked it up and cooked.

I don’t cook because, for whatever reason, it’s a huge stressor for my depression. I think I just put too much pressure on myself when I do try to cook, and if I fail then I spiral down with blame and recrimination. That being said, now that I’m single I have a lot more time/energy/mental wherewithal; so I may give it another whirl.

Chrissy

April 21, 2019 at 11:41 pmHey Abigail—it sounds like you’re doing well with your food costs. I’m not sure saving that extra $50 would benefit you as much as maintaining good mental health. You’re wise to spend instead on what’s essentially self-care. No need to feel guilty or bad!

GYM

April 28, 2019 at 12:26 pmI love the Flipp App. I use it all the time.

We cook (or I mean I cook haha) most meals at home but then once a week do to take out since I’ve been working full time.

It’s exhausting!

13 years as a SAHM that’s so cool!

Chrissy

April 28, 2019 at 1:25 pmCooking does require time and energy, so takeout once (or even twice) a week is totally reasonable. If I worked full-time, we’d do the same.

It’s worth it just for maintaining your sanity! (Even more so when you’re very pregnant—as you are!)

MisFIRE

December 2, 2019 at 11:36 amSome great, actionable ideas here! Especially the idea of self improvement through books – I’ve done that with finance books but I totally could stand more self improvement with family relations… I love the idea of renting out a bedroom to students… How did you manage to do it part time? I’m trying to figure that out because with small kids of my own, it would be harder to have a permanent tenant…

Chrissy

December 3, 2019 at 11:20 pmHi again MisFIRE! Great question about hosting students. It’s actually really easy to scale it to just the right schedule to suit your family.

Students generally stay from a few days to many months, and you can accept or reject the placements that don’t suit you. You can also choose how many students to host at one time and what time of year you want to host. It’s very flexible!

The way we host part-time right now is with an agency who specializes in bringing high school groups from Japan. These groups tend to only stay for 3-4 days at a time, so it’s very manageable for us.

We take 2-4 placements a year just to earn a bit of pocket money for our vacations. It’s the perfect amount of hosting for us right now!

I’m happy to answer any other questions you might have. Feel free to reply to this comment or email me through my contact page.

Courtney

May 24, 2020 at 3:58 amThis article is pure inspiration. I am somewhat of a SAH Dad, and I have been inconsistently trying to implement a lot of the strategies that you’ve listed here.

Seeing the progress you’ve made is a huge motivate boost! Love the idea of using the library. Also I drove my car into the ground too – refuse too pay a car note.

Slowly adding to my list of tactics. This article will definitely help me do that.

Thanks for inspiring!

Chrissy

May 25, 2020 at 8:24 pmHi Courtney—I’m so glad to hear this was helpful to you! I don’t feel we’re unusual or that we’ve done anything that’s out of reach for others. This is what I wanted to show in this post—with a little bit of elbow grease, planning, and effort, most of us can cut our expenses and save more money.

It sounds like you’re on the right track! Keep up the good work… and thanks for taking the time to comment. You made my day!

Family Money Saver

June 18, 2020 at 10:30 amI’m a big fan of the combination of discount grocers and a stand up freezer. Why pay more for the exact same products, right?! Congrats on being able to stay home with your kids, that in itself is worth a lot.

Chrissy

June 18, 2020 at 9:51 pmHi Family Money Saver—I couldn’t agree more! It makes no sense to shop at fancier stores for the exact same products. Sure, I like their lighting and displays, but I like my money more, ha ha. Thanks so much for coming by.

I just poked around your site and am enjoying your content. Lots of helpful tips there!

Baby Boomer Super Saver

October 25, 2020 at 1:02 amWhat, you don’t spend your days watching soap operas, drinking coffee with other moms, and shopping, Chrissy?!

Haha, just kidding. I know you don’t do any of those things because you write such a terrific blog. You probably don’t have time for watching soap operas between writing your blog and taking care of your family. These are great ideas for saving money to put towards retirement and financial independence. I really like the way you’ve shown the estimated savings for doing each one. Stacking these strategies is a powerful way to find success on the path to FI.

Chrissy

October 26, 2020 at 5:33 pmHi Kathy—you are always so kind and supportive. 🙂 Thank you for reading and sharing this post. I hope it shows that small, ordinary habits, repeated over time, can result in big savings!

Rommel

November 18, 2021 at 9:03 amTons of amazing great money saving tips and ideas which we practiced ourselves. We are huge bargain hunters and have frequent visits in few thrift shops.

One find that have a huge impact was the “Wealthy Barber” by David Chilton which cost us $3.99.

Chrissy

November 18, 2021 at 4:03 pmHi Rommel—thrift shops are great! They’re fun to shop at, keeps things out of landfills, and saves money. The Wealthy Barber is one of my all-time favourite personal finance books. (Though it could use some updates!)

Thanks so much for taking the time to comment. 💗

FI_nally

June 16, 2022 at 3:15 amThank you so much for sharing! I can relate so much to this. Especially love that you’ve taken a mindful pass on self-imposed pressure to keep up with the Joneses. We are big library users too and so thankful that our local libraries recently in the past year stopped imposing late fees. It had gotten ugly for awhile with the volume of books we were checking out at a time! 😁

Chrissy

June 17, 2022 at 8:28 pmHi FI_nally—comments like yours make me smile and make the effort of blogging all worth it! It’s always nice to “meet” like-minded people who share our values. In my kids’ younger days, it wasn’t unusual for us to have 100+ books checked out from 3+ library systems at once! So I know all too well how much late fees can stack up, LOL. To make myself feel a little better, I would consider the late fees as a donation to the libraries we loved so much. When I looked at it that way, late fees end up being a very cheap user fee. 🙂