Muddy fall weather doesn’t stop Mika from having fun!

It’s time for another update! October and November flew by… and here we are, with the holidays on our doorstep. Here’s what happened at the ESBFI household this fall:

Life update

Final get-togethers

One last walk at the University of BC campus with friends

As the warm, dry weather came to an end, we squeezed in a few last outdoor meetups with family and friends. We thoroughly enjoyed these final picnics, backyard dinners, and walks.

By mid-October, we shrank our bubble back down to just the four of us. Zoom dinners and meetups have once again become our norm.

They’re definitely not the same as seeing our loved ones in-person. But the upside is we see some family members more often now than we used to. That’s been an unexpected bonus (which might be a good reason to continue Zoom dinners even post-pandemic).

A very COVID Halloween

Kid 2 (dressed as Marshmello) posing with a Dr. Bonnie Henry Halloween sign

We waffled on Halloween for weeks—should we go or skip it this year? Normally, we spend Halloween with Kid 1’s best friend and his parents. It was a long and enjoyable run and we were sad to potentially miss out this year.

I texted our friends and asked what they had planned. They said if we were taking Kid 2 out to trick or treat, they’d happily tag along. So, on Halloween night, we dropped off Kid 1 to hang out with his best friend (with an outdoor heater, blankets and hot chocolate). Then, his parents went with us, Kid 2 and Mika to trick or treat. It turned out to be a fun, memorable night.

Something we’ll always remember (that was so uniquely COVID) is all the creative and funny ways our neighbours handed out candy from a distance. There were chutes coming out of mailslots, Hot Wheels tracks, honour-system bowls on the doorstep, and even a shovel.

It brought new meaning to the phrase, “being together, apart”. I found it heartwarming that so many of our neighbours went to such lengths to make Halloween happen. Thanks, neighbours!

This sign made me smile 🙂

Remote learning continues

In October, I detailed the why, what and how of our boys’ remote learning experience. It’s been nearly three months, and things continue to go well. We’re fully into the routine now, and the boys are thriving with this style of learning.

Kid 2 (in Grade 7) is nearly finished two of his courses for the year (yes, you read that right). He’s also far ahead of schedule for another course and on-track with the courses where his teachers set the pace.

I’d heard that this regularly happens when home learning—motivated, engaged kids can progress very quickly. I never really believed it, but now that I’ve seen it for myself, I’m a believer.

For Kid 1, things are going a bit slower because he’s in Grade 10 and the material is more challenging. Even so, he’s also ahead of schedule. Additionally, he only does school work 5 hours per day. (During regular school, he’d be out of the house for 7+ hours, then come home to hours of homework.)

I would really, really love for my kids to continue remote learning. It’s been a lovely experience so far, and the boys are excelling with it. But the social aspect of school and missing friends are still real concerns. We’ll just have to continue evaluating things as the year progresses.

Investing update

Our annual financial planning meeting

In November, I met with our financial planner, Ed Rempel, for our annual review. I love talking to Ed and soaking up his knowledge, so these meetings are always fun for me.

M couldn’t make it, so he sent some questions he wanted me to ask Ed. Basically, they reflected his feelings that FI isn’t real until we actually get there. He wanted more reassurance that we’re actually on the right path and that we had safeguards in place for the worst-case scenario.

After sharing M’s questions with Ed, these were my takeaways:

- We’re still on track to hit our FI number as planned, and everything is humming along nicely.

- Even if our portfolio takes a hit when (or soon after) M stops working, we’ll be okay.

- Ed had clients in this scenario during the 2008 crash. They cut back their spending a bit ($100–$200 per month) and within two years, their investments went back up and exceeded their previous high.

- Ed also reminded me that, in retirement, we’ll only sell a tiny portion of our portfolio, one month at a time. This means the vast majority of our portfolio will remain untouched, even in a bad year.

- We have many safety margins built into our plan: conservative estimates for portfolio growth, worst-case estimates for inflation, flexible spending, the ability to ramp up side income, controlling taxes with strategic withdrawals, or working one more year to add extra cushion.

When I shared this info with M, he was comforted to be reassured again that we’ll be more than okay. I think he still won’t believe it until we reach FI, but having Ed’s guidance gives him a lot more confidence.

Our investment performance

To be honest, I was too busy following the craziness of the US election to pay attention to the stock market. However, based on our portfolio, it looks like October wasn’t great but November was pretty amazing:

- October: -2.6%

- November: +8.8%

The big increase in November was unexpected, and helped to push our portfolio to its highest point yet. It’ll be interesting to see what December brings.

Some notes on our numbers

- I’m lazy, so I don’t subtract contributions when calculating our investment returns.

- I know this makes our numbers less accurate, but our contributions make such a tiny difference at this point. They don’t change the numbers all that much anyway.

- The majority of our money is invested with our investment manager, but we also hold some investments in M’s group RRSP and a tiny amount at Questrade. I include all of these accounts in our calculations.

- I don’t include our kids’ investments or RESPs in our numbers.

Spending update

We bought a free microwave

I know the subtitle sounds weird, but it’s true—we bought a free microwave! What happened is we found a used microwave for $150 on Craigslist. That was all we wanted, but it came with the trim kit that you can install to make it look fancy like a wall oven.

The fancy trim kit our microwave came with

We didn’t need the trim kit, and I found out that it still sells for $280 + tax brand-new. Since it was in like-new condition and had all the necessary parts, M suggested that I try to list it for the same price we bought the microwave for—$150.

I listed it on Craigslist, but all I got was two weeks of crickets. I was about to reduce the price, but out of nowhere, someone emailed to ask if it was still for sale. These types of inquiries usually lead nowhere, so I wasn’t holding my breath.

To my surprise, the buyer was serious and arranged a pickup date and time… and stuck to it. He actually showed up, paid us, and took the trim kit back to his happy wife waiting in the truck. (She was apparently desperate to find one of these kits to finish their kitchen reno, and they were having a tough time locating one.)

So that’s the story of how we ended up buying a free microwave. As a bonus, I’m thrilled that the trim kit went to a good home where it’ll be put to good use. 🙂

My new-to-me phone

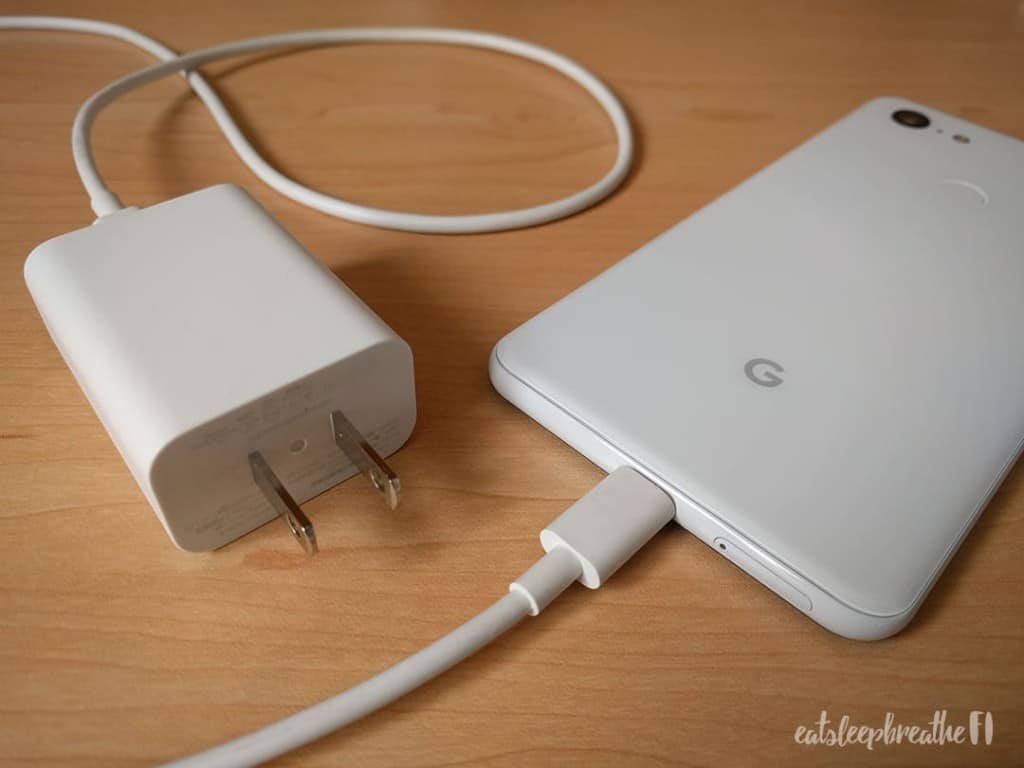

My new-to-me Google Pixel 3XL

A couple of years ago, a relative lent me his Google Pixel 3XL. It came free with his work plan, but he preferred his even-fancier phone. The Pixel would’ve gone unused, so he offered it to me.

However, his plan will renew soon, which means it’s time for me to return the phone. This time, he’s going to keep the new phone for himself, so I started shopping for a replacement. I was still very happy with the Pixel 3XL, so decided to replace it with a used version of the same phone.

Buying used

Previously, I purchased used phones from the classified listings at M’s office. There’s a level of safety built into that system since these people work together—they’ll have to face each other if they sell a lemon to their coworker!

However, no Google Pixel 3XLs were listed on the classifieds, so I decided to try Facebook Marketplace. (For me, it felt safer to buy a big-ticket item through Facebook rather than Craigslist. At least on Facebook, the sellers are rated and you can check out their profiles.)

To my surprise, there were lots of reputable sellers offering the Pixel 3XL, and at better prices than we were seeing for used phones on eBay and Best Buy. I found an amazing deal for a like-new Pixel 3XL in white—and it came with a huge selection of cases and screen protectors.

The seller was asking $420, but there were black versions of the phone selling for a lot less. I decided to offer $390 and see what he said. I was thrilled when he immediately replied to say he’d accepted my offer.

Completing the sale

A few days later, I met the seller at a Starbucks and completed the sale (with masks on). The phone was, as stated, in pristine condition and the assortment of cases was crazy! (I have no idea why anyone would buy seven cases for one phone?!)

I kept one case and listed the rest on Craiglist—hoping for some of the same luck I had with the microwave trim kit. So far, I’ve sold one case for $7. But it’s only been a couple of weeks, so I’ll keep waiting. If they all sell, I’ll make $50 back. I’ll keep my fingers crossed!

Kid 1’s new laptop

The laptop that Kid 1 bought (Photo credit: Asus)

Believe it or not, the last time we bought a new computer was ten years ago! That’s when M bought and assembled the pieces to make our desktop computer. (It’s my main computer now, and it’s still trouble-free and running well.)

For the boys’ use, we were very fortunate to receive two hand-new-down laptops from M’s brother. Kid 2’s is about five years old and Kid 1’s is six. Kid 1 wanted a new gaming laptop last year but decided that he wasn’t ready to drop $1,000 at that time.

Instead, he invested his savings and put up with the slow laptop. (This kid would’ve crushed the marshmallow test!) He held out for a whole year but finally decided last week that he was ready to make the purchase.

Fortunately for us, this happened just days before Black Friday. He and M did some research and found an open-box laptop at Best Buy. It was $869.99—a $130 savings compared to the Black Friday price and $239 off the regular price!

We made a deal with Kid 1 that we’d pay for a portion of the laptop as his Christmas gift. He’ll pay for the rest with gift money he’ll receive for Christmas (and some of his savings, if needed). The laptop just arrived the other day, and it’s now the fastest (and coolest) computer in the house!

Donations

As I’ve mentioned before, we feel so fortunate that M’s job has been stable through this pandemic. We feel it’s important to give back when and how we can.

Fortunately, there have been some matching donation opportunities recently (which help our donations make an even greater impact). In addition, when M donates through his work portal, his company matches every dollar. This ends up being a tripled donation in some cases for us, which is amazing!

The next donation we plan to make is one you might want consider—to Covenant House Vancouver or Toronto. Right now, there’s a triple-match that’s partially funded by none other than Vancouver boy Ryan Reynolds and his wife Blake Lively.

The campaign ends December 31st, so be sure to donate by then to get the triple-match!

Photo credit: Covenant House Vancouver

And that’s a wrap!

How was life for you this fall? Did your investments go up as well? What about Black Friday—did you score any deals, or did you decide to opt-out this year? I’d love to hear from all of you!

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

25 Comments

Family Money Saver

December 2, 2020 at 4:18 amYou guys have been savvy shoppers! I’m really impressed that your kids have such restraint with their purchases, things like shiny new laptops are hard to resist at that age. We’ve tried to be very focused with our Christmas spending and find great deals or gently used items as well.

Great to hear that school is going well too. They really seem to get into the routine it seems after a few months and then it’s just business as usual. Always enjoy your updates!

Chrissy

December 2, 2020 at 11:42 pmHi Family Money Saver—I have an uncle that calls me NFM (No Fun Mom) ha ha. He says I make my kids wait for everything and don’t let them have enough fun!

I know he’s only joking, but it has been really great to have taught my kids delayed gratification from a young age. They pretty much police themselves now. It’s very rare that we have to ask them to think twice about a purchase. It cuts down on a lot of parenting stress!

I hope homeschooling is going well at your house too. (Though I know it’s a lot tougher with younger ones.) Thanks for commenting and reading!

Maria @ Handful of Thoughts

December 2, 2020 at 6:34 amI love the microwave story. Often when we want to make a purchase my first instinct is can I find it used. Not only is it a better price it also helps keep things out of the landfill.

Great update. Ed Rempel has been on my list of people to reach out to. I have some pensions questions that he may be just the person to ask. I will add this as a priority for the new year.

Chrissy

December 2, 2020 at 11:46 pmHi Maria—I am with you on buying used. It’s what I try to go to first, both for the cost savings and to lessen the burden on the Earth.

Ah yes, the great pension decision! Ed’s definitely an excellent resource for that. I hope you’ll sort it out. It’s a big decision!

Chris @ Mindful Explorer

December 2, 2020 at 8:54 amA well rounded update and good to hear the whole family is doing well. Don’t fear on the FI path, bumps and detours will exist but you will get there just fine as long as you keep in mind it won’t be 100% smooth.

Chrissy

December 2, 2020 at 11:49 pmHi Chris—I should hire you as my FI psychologist once we’re ready to pull the trigger, LOL. You always have such wise words to share.

I’m sure there’ll be plenty of bumps and detours. It’s nice to know that there are others, like you, who’ve gone before us (and who have not only survived, but thrived)!

Maggie

December 2, 2020 at 10:53 amGreat job buying the used phone! I just bought the new iPhone SE. it was pricy but I’d been putting money aside for a year and I pulled the trigger on Black Friday so I got a $70 gift card with it. I plan to make it last 4 years.

Chrissy

December 2, 2020 at 11:54 pmHi Maggie—$70 back in gift cards is a nice discount! I think four years is a good long time to keep a phone. That helps to make the upfront cost worthwhile. Have fun and enjoy your shiny new phone!

Jeff

December 2, 2020 at 1:52 pmLove to see your 6 year old practicing delayed gratification! I have a younger brother (13 yo) who also actually built his own PC. Unlike your son, however, my bro decided to spend all the money in his bank account as soon as he got access to it! Great content Chrissy. Keep it up!

Chrissy

December 2, 2020 at 11:57 pmHi Jeff—LOL, my son is actually 15. If he was that restrained at 6, I would’ve fallen out of my chair!

I can’t believe your 13YO brother built his own PC. That’s impressive. You told me previously that both your parents are financial planners. I’m sure he’ll slowly learn to be more prudent with his money.

(Maybe you should tell him to read your blog!)

Tawcan

December 2, 2020 at 5:55 pmGreat update. A little bump on the FI journey is nothing to worry about. 🙂

Chrissy

December 2, 2020 at 11:58 pmHi Bob—you’re right, little bumps aren’t a worry. Now I have to convince my husband! I’m sure he’ll get more comfortable with time.

Latestarterfire

December 2, 2020 at 11:25 pmGosh, you rock at your purchases and sales! I have yet to try FB & Gumtree (similar to Craigslist) Glad your boys are doing well with remote learning 👏

Chrissy

December 3, 2020 at 12:01 amHi Latestarterfire—I’d heard of Gumtree but didn’t realize it was like Craigslist. You taught me something new today!

It’s definitely worth trying—it could save you lots of money! We often buy used things, like kids’ sports gear, use it for a few years, then resell it for the same price.

It’s amazing how the resale economy works!

Sam

December 3, 2020 at 11:42 amGreat update! Are you still planning to head overseas in March?

Chrissy

December 3, 2020 at 9:35 pmHi Sam—the answer is most likely no. But we’re holding out hope, so still haven’t cancelled our flights! We’ll have to wait and see.

Sam

December 4, 2020 at 6:32 amThank you so much for your response! I’ve been so curious about what others are doing in terms of travel planning for next year. I’m still hopeful for you as well! 🙂

Chrissy

December 4, 2020 at 9:30 pmHi Sam—you’re very sweet. It’ll be interesting to see when and where travel will finally restart. I hope your travel plans come to fruition in 2021!

Money Mechanic

December 3, 2020 at 5:51 pmGlad you put that link to the Covenant house at the end there. Motivated me to sit down and finish off going through all the organisations I wanted to contribute to this year. Love the microwave story!

Chrissy

December 3, 2020 at 9:37 pmHey MM—it seems to be a good time of year to donate. The Terry Fox Foundation just emailed to say they also have a match going until the end of the year. I love all this generosity going around. Makes this yucky year a little less so.

Chris@TTL

December 5, 2020 at 11:47 amGood job with the microwave! We’ve run into that sort of a thing before. A little patience, a little effort—you can wind up with the thing you really wanted deeply discounted or even free.

I did something similar with an iPad that came with their high-end keyboard. 🙂

Glad to see you guys were able to maximize your donations through all the matching layers. Love those multiplier effects! Good on you.

Hope the winter holidays continue to go smoothly!

Chrissy

December 6, 2020 at 3:03 pmHi Chris—you’re totally right that patience and effort can save so much money. Our modern culture of wanting and expecting to get things we want RIGHT NOW is so detrimental to our environment and wallets.

I’m always inspired by your and Jenni’s charitable giving, and hope that by sharing our giving efforts, I’ll likewise inspire others to give however they can. Thanks for coming by to comment!

Julie

February 22, 2021 at 7:46 amHI Chrissy,

I’ve just discovered your blog and I find it helpful and well-written! I’m looking for a financial planner right now and I see you mentioned Ed Rempel. May I ask if you went with the full-service plan?

Chrissy

February 22, 2021 at 9:17 amHi Julie—thanks for reading! We’ve been Ed’s full-service clients since 2018 and are very happy with the service and investment performance. 👍

Julie

February 22, 2021 at 10:36 amHi Chrissy! Thank you for your reply!