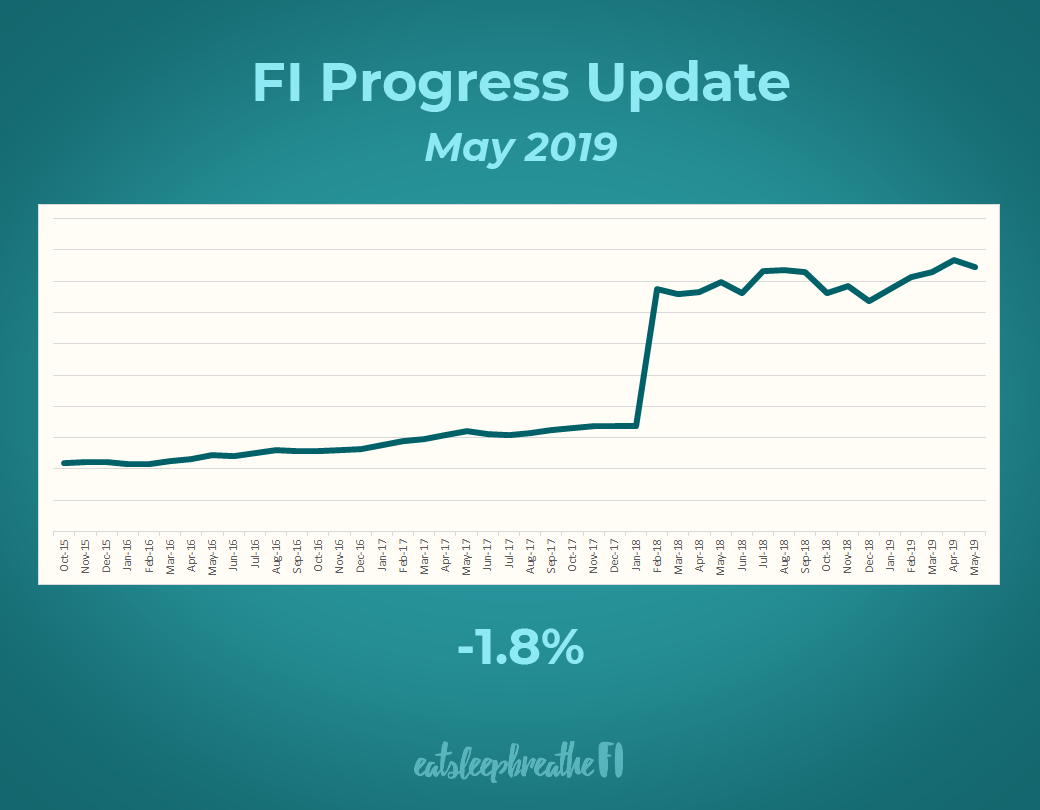

- The chart displays the total value of our retirement investments. Our RESP, cash holdings, and home equity aren’t included.

- The huge jump in February 2018 was due to us refinancing our home and investing the funds. (This leveraged investing strategy cut our time to FI by four years.)

- The percentage at the bottom represents the growth/drop in our investments compared to the previous month. This includes investment growth/losses and any additions we made to our accounts.

May 2019 FI progress update

I thought May would be a quieter month for us, but it turned out to be another busy one! Here are our FI and money-related happenings for May:

Changes to my chart

After some thought, I decided to make some changes to my chart:

- I removed the expenses line because it’s not all that helpful.

- I removed the line indicating our FI number because it reveals too much info.

- I’ll now only show the growth/loss in our portfolio because I still think it’s an interesting metric to share. (Plus—I need some kind of image for this update every month!)

Why the changes?

As I’ve mentioned before, I worry that revealing too much info on my blog could negatively impact M’s career. I still feel strongly about that, but I wavered a little when Angela left this inspiring comment on one of my previous posts:

“I’ve actually found that sharing my FI journey at work has been a very positive thing specifically because I don’t plan to quit work when I hit financial independence. There’s something powerful about being able to tell your employer that you don’t HAVE to be there (even hefty FU money works) but letting them know that you still WANT to be.”

I love that Angela’s had such a positive experience with her employer. Maybe it wouldn’t be so bad for M to reveal his FI plans? Hmmm, I don’t know. For now, it’s TBD!

Our portfolio decreased by 1.8%

Our portfolio actually dropped by 2% in May. But since we rolled in some of M’s company stocks (that just vested this month) our overall loss came to 1.8%. I’m guessing the drop in the markets was due to nervousness about the China tariffs. But since I don’t pay attention to that kind of news, I’m not sure! (And I won’t waste any time worrying about it.)

M got a promotion—yay!

Over the last couple of years, M’s worked hard to fulfill his role as an art director—even though he didn’t actually have the job title. That finally changed last week when M was presented with a letter confirming his official title change (and commensurate pay increase). Woo hoo!

Receiving this formal recognition is so meaningful for him. It wasn’t easy taking on the art director role, and it took a lot of time and effort for him to get here. I’m so proud of what he’s accomplished.

Our plans for the extra income

Here are our top considerations:

1. Invest it

Being FI-minded, this is our top choice. But at this point, new additions won’t decrease our time to FI by much—it’s now mostly compounding that drives the growth of our portfolio. Knowing this, we started thinking of other meaningful ways to use the money.

2. Travel more

Family travel has always been a priority for us, and it’s even more so now. Our boys are 11 and 13, and the years left to travel with them are quickly slipping away. We’d love to use the extra income to do more local travel.

3. Eat more luxuriously

Apparently, M’s been restraining himself and won’t buy ‘expensive’ foods like caviar, nice steaks, black cod, or… chicken wings! I had no idea he was depriving himself and told him he should go ahead and buy all the foods he likes! (Besides—when they’re only occasional treats, these items aren’t going to break our budget.)

4. More ‘stuff’

M thought of a few things that’d be nice to have, but none of them were all that important. He realized he’d rather put more money into our investments or take more trips. As for me, discovering FI has cured me of just about every material desire. Nowadays, I’m happiest spending only on necessities and experiences.

Our decision

What’ll most likely happen is we’ll spend a bit on short trips and nice food, then invest the rest. It’s an important decision, so I’ve emailed our advisor Ed for advice. He’s even more of an optimizer and way smarter than me—I know he’ll come up with a good plan.

Choose FI Vancouver meetup

In early May, a bunch of Choose FI fans (and a handful of Mustachians) met up at a local park to mix and mingle. We chatted about FI and got to know each other as we feasted on a tableful of potluck dishes. Yum!

I was thrilled to finally meet my blogging friends Money Mechanic and Phia, as well as others that I’ve connected with through the Facebook group. It was a fun and engaging meetup, and I look forward to more in the future!

Thanks again for organizing the meetup Shaidah—you’re the best!

The $550 dinner out

As much as we love eating out, it’s expensive and not all that healthy. So we try to save it as a treat for special occasions.

Related: How to Reach FI on One Income

Well this month, we had a special occasion… and spent $550 on a single dinner out. Gulp! Aside from our wedding, that’s the most expensive meal we’ve ever paid for!

via GIPHY

Long story short, it was a special meal for a good friend and her family. And because they’re extremely wealthy (like, crazy rich Asian wealthy) it had to be a fancy meal in a nice restaurant. While it was painful to spend that much money on a single meal, we don’t regret it one bit. We had a lovely time with my friend and her family, and the food was amazing.

Experiences like this teach me that sometimes, money does buy happiness. This is especially true when you spend on experiences. (And I think a fancy meal with a good friend counts as a pretty special experience!)

My mother-in-law made me proud

At dinner with my in-laws’ last week, the topic of financial independence came up. When we mentioned M could potentially retire in his 40s, one of our dinner guests was genuinely confused. They asked why M would retire so young and what he’d do with his time.

This person is a successful high achiever who’s good at and loves their job. They’re also enviably high-energy and driven. Understandably, it was hard for them to fathom M leaving the traditional workforce at such a young age.

I was about to respond, but M’s mom piped up and said, “It just means he’ll have choices. He can keep working, or do something else if he wants.”

I can’t tell you how proud I was of her at that moment! Even though I know she’s on board with FI, seeing her so passionately explain FI to someone else almost brought tears to my eyes! It means she truly gets what FI’s about.

We went on to explain to our guest that M would most likely continue in his job post-FI. But just knowing that he’s continuing on because he’s choosing to, not because he has to, is freedom.

After explaining all that, our dinner guest chuckled and agreed—FI wasn’t so crazy after all.

Related: Debunking FI/RE Myths

A lesson in value for Kid 1

Every year, Kid 1’s high school takes a group of Grade 9 students on a two-week trip to Japan. We love Japan and wanted Kid 1 to enjoy this amazing trip with his friends. So, over the last two years, we saved up the money—expecting that we’d send him when the time came.

But on the eve of the application deadline, we took a step back. We realized the cost of sending Kid 1 on this trip was half of what we spent on our family trip to Japan in 2018—for four weeks, for four people.

Additionally, we’d already seen half the things the school was planning to see. (And the other half that we hadn’t seen, we wanted to see too.)

We decided it didn’t make sense to send Kid 1 with the school. What we really wanted was to go back to Japan with him—as a family.

We were so nervous about breaking the news to Kid 1. After all, we’d bought into this trip for over two years, and it was all his friends could talk about at school. This was a very sudden about-face.

The ace up our sleeve

Thankfully, we had an ace up our sleeve… Kid 1 also wanted to do the Grade 10 Tall Ships Adventure trip. (Students get to live aboard and operate a tall ship as it sails from Victoria to Vancouver over five days. So cool!)

We’d previously told Kid 1 there was no way we’d pay for Japan and Tall Ships… but now that we were taking Japan off the table, Tall Ships was a possibility. We knew this could help to soften the blow… and it did. Phew.

Kid 1 took the change in plans surprisingly well. He could clearly see that it was a far better value for us to go to Japan as a family.

He also realized that the Grade 10 Tall Ships Adventure was a better value than the Japan trip. Not only is it a fraction of the cost, but it’s something we’re unlikely to do as a family. (Whereas with Japan, we’ll definitely be travelling there again.)

Kid 1’s still sad to miss out on the fun his friends will have in Japan together, but we all know this was the right decision. And I firmly believe that real-life experiences like these (disappointments and all) are the best kind of money lessons our kids can have.

And that’s a wrap!

What about you? Do you have any successes or stories to share from May? I’d love to hear about it—leave a comment below!

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

18 Comments

Josh

June 3, 2019 at 11:02 amMay was a month for FI connections! I got to hang out with 7 on Cinco de Mayo (Seonwoo, RoseColoredWater, MK Williams and her husband Jason, FromOneGeek to another, and FrugalReckless and her husband), had a 40-minute phone call with BudgetEpecurean on May 10, met with MsFiology and other O-FI-O friends in Cleveland on May 19th, AmandaDashPage came to visit with me in Cleveland on May 24th, and I flew to San Diego this past weekend 5/31 to see the Playing with FIRE premiere, but I won’t count that because it actually happened June 1 😁 Also, The Fioneers interviewed me and it was posted May 20th!

Have to say, it might have been the best month I’ve ever had 🥰 Everyone was incredible

Chrissy

June 3, 2019 at 9:00 pmYou’re a social butterfly Josh! It’s no wonder you’re so well-liked in the FI community. I didn’t realize the Fioneers interviewed you. I love them, and would love to learn more about you… I’ll go find that interview and read it soon!

Shaidah

June 3, 2019 at 1:57 pmI have been thinking about organizing another meetup, perhaps in July or August. Thanks for the shout out. And $550 dinner out?! Wow!

Chrissy

June 3, 2019 at 9:02 pmYeah, that dinner was a tough one to pay for. Not something we’re likely to repeat!!! (And yes, please plan another event. It’d be lovely to get together again.)

Tawcan

June 3, 2019 at 2:50 pmCongrats on the promotion! Yea!

I’m sad that we missed the Choose FI meetup in May. We spent that day in downtown Vancouver. Would love to come out for another meet up.

$550 dinner out seems a lot but that totally depends how many people had the meal together. A LONG time ago I remember having dinner with family friends, there were maybe like 40 or so people and the bill came out to close to $1,000. The person that paid just put down a $1,000 CAN bill (the purple one). As a young teenager, I was like “damn, that’s a lot of money!”

Chrissy

June 3, 2019 at 9:11 pmThanks Bob. 🙂

I’ve never seen a $1,000 bill—that’s something you never forget! Our $550 dinner was for 9 people, so about $60/person. For that quality of food and ambience, it seems to be a fairly typical price in Vancouver. So maybe I’m silly to be shocked?

PhiaFreedom101

June 3, 2019 at 3:36 pmCongrats on your husband’s promo, and the pay increase! Yay 🙂 so motivating when hard work is recognized (in title and monetarily!!)

Reading about your decision with your son’s Japan trip made me feel total parent empathy for you guys!! I actually experienced an almost identical scenario when I was a kid and my hockey team went to Japan to play for a month. I remember it being disappointing on the face, but also totally understanding my parents rationale (their reasons were different than yours) but as it often is in life, the delivery made all the difference.

Cudo’s to you guys for making and delivering a tough decision, but with better long term value for the whole family, and a huge high five to Kid 1 for having the perspective to see the bigger picture as well!!

Chrissy

June 3, 2019 at 9:21 pmThanks for the kind words and congratulatory message Phia! It’s sure hard to be the bearers of disappointment for our kids. But you’re right—the delivery makes all the difference.

I just read your latest post and this is exactly what you wrote about. We didn’t just say no to Kid 1 or tell him “we can’t afford it”. That might have been a simple, straightforward answer. But it wouldn’t have been satisfying to him nor would it have taught him anything.

Once again, thanks for your insightful comment Phia!

(And for anyone who reads this, I highly recommend checking out Phia’s post. Like everything on her site, it’s thoughtful and well-written: https://freedom101.ca/2019/06/03/4-words-i-try-never-say-to-my-kids/)

T on FIRE

June 5, 2019 at 6:31 amWoohoo! Congrats to M on the promotion! My Net Worth went down as well this month, but best not to fret. STay the course. $550 for dinner?!! I once considered doing this in 2018 while in Italy and relatively close to a 3 Michelin star restaurant (rated 3rd in the world at one point…have you seen Chef Massimo on Chef’s Table??) Anyway, it was tough to get in, and we resigned ourselves to the fact that we didn’t NEED to spend 270 Euro each on the most amazing meal possibly in the world. haha. So, kudos to you for going for it, and enjoying that time with your friends. Lastly, TALL SHIPS SCHOOL TRIP?? Why wasn’t this an option when I was in school?? That sounds like an amazing trade, considering you’ll be going to Japan eventually as a family (personal dream of mine too 🙂

Chrissy

June 8, 2019 at 6:11 pmAww, thanks for the comment T! Oh my gosh—a 3 Michelin star restaurant? Amazing! Maybe it can be something to include on your post-FI bucket list. 🙂

I didn’t mention it in my post, but that’s part of the reason why it was important to us to treat my friend and her family to such a nice meal. When we were in Korea, she was also there visiting her family, and they took us to a 1 Michelin star restaurant. It was very fancy and very pricey.

So this was the least we could do to show our appreciation for their generosity. I’m sure our $550 meal didn’t even come to half the cost of the meal they treated us to. 🙁

Kris

June 6, 2019 at 3:00 pmCongrats on M’s promotion and having an official job title as art director. It’s always great when hard work and dedication pays off.

So cool that your son was able to take that sailing trip instead of doing both. That looks like a fun trip to do and get to operate the ship. I wish they that option when I was in HS especially since we’re a coastal city as well in the Bay Area. Also great that he sees the value of not going to Japan because the costs sounded expensive and better off going there at a later date.

Now that sounds like a dinner worth spending for. Experiencing spending time with friends and their family and having a great time sounds like that $550 dinner was worth every penny. We spend around $100 for breakfast for my family on Mother’s Day and loved doing it because it a time to spend with the people you love and had great time

Chrissy

June 8, 2019 at 6:06 pmI know from reading your blog that you see your family quite often—we’re the same. It’s absolutely worth the cost to enjoy an occasional meal out together.

(And Kid 1 hasn’t gone on the tall ship trip yet… another couple of years until he gets to go as he’s only in Grade 8. He can’t wait though!)

Ms. Mod

June 8, 2019 at 8:17 amAwesome month Chrissy! I’m loving the mind set of “choosing” to stay with your employer shared by Angela. That comment from your MIL made me think about my mom suddenly explaining our FI plans to family proudly while she always seemed the most critical of these plans when we shared in the past. It’s so great when family pleasantly surprise us and it’s nice to feel like what we tell them is being absorbed ahah! Great on kid 1 for being open to the flexibility, great lesson! Japan is definitely on our bucket list, sounds like an amazing family trip to cone for you guys when you go visit the things you missed the first time around!

Chrissy

June 8, 2019 at 6:02 pmThat’s such a nice story about your mom explaining your FI plans to others. Way to go mama! I think it does take a while for FI to sink in. It’s so unconventional. But once you see the light, it’s hard to imagine living life any other way.

As always, thanks for stopping by to comment Ms. Mod. I always love hearing from you. 🙂

Angela @ Tread Lightly Retire Early

June 8, 2019 at 8:23 amHey, that’s me in there! And I know some people haven’t had great experiences revealing to their employers, so it’s fefi a nuanced thing. That said, I think the more conversation about financial freedom in general, the better!

Chrissy

June 8, 2019 at 5:59 pmYes, it’s you! (Can you tell that you inspire me? 😄)

You know what? When I think of it, my husband has actually told a few people at work—but mostly friends or colleagues in other departments.

The reception has actually been very supportive. (But sadly, no takers yet as far as following in his footsteps and pursuing FI.) Still, nothing bad has come of it, so maybe I’m worrying for nothing!

GYM

June 23, 2019 at 8:00 pmCongratulations on the promotion to your husband! Okay I’m curious to know where this $550 meal was for 4 people!? That’s not too too bad, if it included wine and tips and a few courses, $100 a person or so?

Okay never mind I just read it was for 9 people, that’s not bad at all if it was a banquet style dinner! 🙂

Chrissy

June 24, 2019 at 12:36 pmHi GYM—yes, it was for 9 people and it was for a seafood set menu at Kirin downtown. Based on the research we did prior to booking there, it seems that around $50/person before tax and tip is the norm for any decent restaurant. So you’re right that it’s not too bad—for restaurant dining. Eating out is just really expensive compared to cooking at home!