Photo credit: Mike Benna on Unsplash

How Much Does it Cost to Live the FIRE Life in Kelowna?

Hello, and welcome to interview #16 in the How Much Does it Cost to Live the FIRE Life interview series! Part interview, part spending report, this series will introduce us to FIRE* seekers from all over the world.

They’ll reveal their essential spending and money-saving tips—all to help us learn new ways to save on our own expenses. As a bonus, we’ll also get to discover the unique advantages and challenges of living in different places around the globe.

*FIRE stands for financial independence, retire early. It’s also known as FI—financial independence. For more info, see my FI School series—it’ll teach you everything you need to know about FI (and FIRE).

About the interview series

I created an intro page for this interview series to help explain what it’s about, what’s included (or not) and why. I’ll also link to all the interviews from the intro page—so check back there to see the entire collection.

Jump to the series intro: How Much Does it Cost to Live the FIRE Life? (The Interview Series)

Disclosure: These interviews may include affiliate links. That means I’ll receive a commission if you make a purchase through my links—at no extra cost to you. Thank you!

Interview #16: Chris in Kelowna, BC

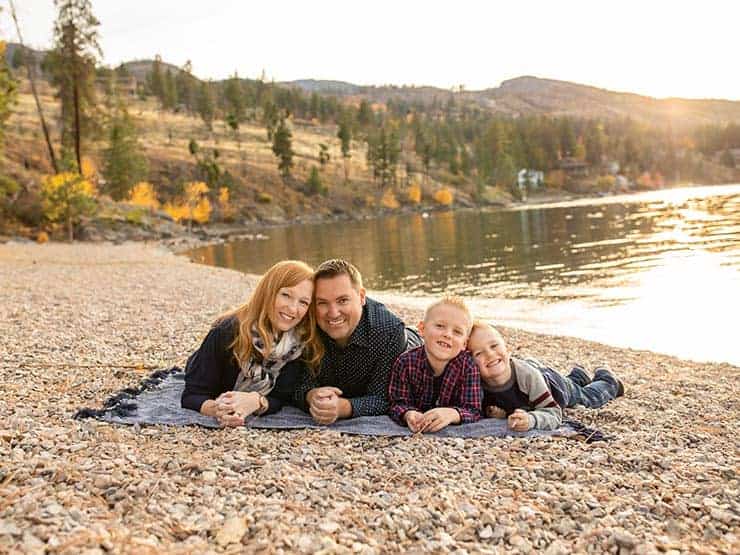

In today’s interview, we’ll meet Chris, who lives with his wife Laura and their two sons in beautiful Kelowna, BC. Incredibly, Chris and Laura went from $0 to $100,000 in liquid net worth in just one year! Their goal is to reach FIRE in about seven years. I have no doubt they’ll get there on time or, even more likely, early!

About My First Million

Chris is quite active on Twitter, where he posts under the handle My First Million. Following his Twitter feed is like getting a motivational pep talk—Chris is so great at lifting others up while sharing his family’s financial wins.

He also aims to be transparent with their numbers and how they manage their money. Chris feels strongly about this, and I admire his willingness to put it all out there. (I’m not quite as brave!)

He also posts videos to share his financial strategies on Instagram and wrote an e-book to detail how he and Laura got to where they are now. In everything he does, it’s clear that Chris cares about others and helping them to succeed.

If you’re looking for a cheerful, supportive friend in the personal finance community, you’ll find that in Chris. It’s been a pleasure getting to know him and I hope you’ll take the time to do so as well—both through his interview below and on his social media accounts.

Table of Contents

Part 1

Part 2

Part 3

Part 4

Part 1: Getting to know you

Tell us about you and your family

We are Chris (39), Laura (41), Matthew (8), and Jonathan (5).

Where are you in your journey to FIRE?

As of the end of March 2021, we’re at 12% to our final goal of $700,000 in liquid net worth.

What type of FIRE are you aiming for? (FIRE, Lean FIRE, or Fat FIRE*)

How Chrissy defines FIRE, Lean FIRE, and Fat FIRE

Some people define Lean FIRE as under $40k in annual spending; FIRE as $40–$100k in annual spending; and Fat FIRE as $100k+ in annual spending.

However, I prefer looser definitions that are not based on hard numbers. That’s because $100k could be Fat FIRE in a small Canadian town but Lean FIRE in San Francisco. That said, here are my definitions:

- Lean FIRE: The essentials with little or no discretionary spending.

- FIRE: The essentials plus a comfortable amount of discretionary spending.

- Fat FIRE: The essentials plus a luxurious amount of discretionary spending.

We’re aiming for regular FIRE. Our final target is $700,000 in liquid investments generating a 10% return. (Yes, 10%. We have been generating over 10% on average with more than a five-year history with family money.) This will generate gross investment income of $70,000 per year.

Chrissy’s note: Some people are able to generate higher-than-average returns on their investments, as Chris has done. However, keep in mind that we’ve been on a very long bull run and these higher-than-average returns are not typical.

For most of us, it’s safer to plan on 7–8% returns and 2–3% for inflation. In addition, it’s normally advised to look at average returns over a longer time frame (at least ten years, but preferably 25 or more).

Tell us about your living situation

We own a single-family home and driving is a must.

Why did you choose to live in Kelowna?

In Kelowna, we could afford a single-family home (four years ago) for what we paid for a shoebox in the Vancouver area. Kelowna offers a great quality of life, small town feel, and good schools. Our kids were in private school in the Vancouver area.

Part 2: The expenses

In this section, Chris shares his essential expenses and best money-saving tips. But before we get started, let’s review some important notes:

Important notes about the numbers

- Only essential expenses are included.

- Discretionary expenses (e.g. travel, gifts, etc.) are not included.

- Expenses are rounded to the nearest dollar.

- Expenses are displayed in the interviewee’s home currency.

- In this interview, the home currency is Canadian dollars.

- For your convenience, I’ve included a currency converter for each expense.

For detailed explanations about which expenses are included (or not) see my How Much Does it Cost to Live the FIRE Life intro post.

1. How much does housing cost in Kelowna?

Mortgage ($1,424/month; $17,088/year)

Note: numbers are current as of March 2021

Our mortgage payments will be lower after our next renewal. We have been blessed with our investments in real estate—hence the small mortgage payment.

We started small with a small townhouse, then larger townhouse, and now a single-family home. Houses in our neighbourhood cost around $850,000.

Property tax ($177/month; $2,124/year)

The $177 per month/$2,124 per year shown here is just for our property taxes. Our water, garbage and recycling are paid separately. Those costs are shown in the utilities section.

Strata/HOA fees ($0)

No, thank you! We don’t pay strata fees since we live in a single-family home.

Home insurance ($97/month; $1,164/year)

We made one claim in the last 10 years. We receive an alumni discount and call in every year to check for additional discounts.

Home maintenance ($21/month; $252/year)

This category includes: home maintenance, repairs, cleaning, and improvements; household goods and supplies; furniture; and appliances.

This expense is small and not worth mentioning. I try and do the work around the house to save money. Maybe $1,000 on appliance repairs over the last four years.

Home equity opportunity cost ($27,442/year)

About the home equity opportunity cost ‘expense’

This category was suggested by The Economist from FI Garage. The intention for sharing this is to calculate the opportunity cost of home ownership versus renting.

In other words: if you invested the amount that’s tied up in your home equity, how much would that be worth after one year of investing (based on a conservative 5% return)?

Note: numbers are current as of March 2021.

Our house is worth $850,000 and our mortgage is $301,153, so we have $548,847 in equity. This equity is slowly getting unlocked. We freed up $35,092 with a readvanceable HELOC.

Note: We want our cake and to eat it too. Four years ago, we bought this house for under $550,000. By unlocking the home equity, we own the house AND dividend-paying stocks. (This is not investment advice—this strategy carries risk.)

$548,847 x 5% = $27,442 in opportunity cost after one year of investing.

Chrissy’s note: Chris’s strategy of unlocking his home equity and investing it is known as the Smith Manoeuvre. At the end of the interview, I share my thoughts on this powerful tactic.

2. How much does transportation cost in Kelowna?

Vehicle lease payments ($600/month; $7,200/year)

We have a car lease for $600 per month. I know this is bad, right? Probably my only concern. However, I love the vehicle—it’s a Toyota Highlander.

Vehicle insurance ($300/month; $3,600/year)

We have two vehicles and pay a total of $300 per month. This rate might be reduced with ICBC’s new structure.

Gas ($350/month; $4,200/year)

We pay a total of $350 per month for two vehicles. Both are reasonable on fuel.

Vehicle maintenance ($50/month; $600/year)

We didn’t have winter tires when we lived in the Vancouver area. Some people in Kelowna also forgo winter tires if they are staying in the valley, but I would highly recommend getting them.

This vehicle maintenance expense includes our winter tires here as well as occasional oil changes. We also just changed the front brakes on Laura’s car.

Bike maintenance ($0)

Zero. Just pump the tires and we are good to go. We mostly just ride around the neighbourhood with the kiddos.

Parking and tolls ($0)

Generally, everywhere has free parking except the downtown core. Laura does most of the shopping in West Kelowna and therefore does not need a downtown parking pass. The only reason I park downtown is for my job and it’s paid for by my employer.

Transit ($0)

None. Kelowna is still building out the transit system here.

3. How much does food cost in Kelowna?

Groceries ($800/month; $9,600/year)

We try and group spending to get free items at Superstore.

Related reading: How to Save Money on Groceries (36 Valuable Tips) and Detailed Flashfood Review (Groceries for 50-70% Off)

Eating out ($350/month; $4,200/year)

This includes entertainment and activities as well. We try and use coupons as much as we can.

4. How much do utilities and bills cost in Kelowna?

Natural gas ($100/month; $1,200/year)

This expense is higher in winter. We’re happy to have natural gas as a heating source as it is much cheaper. Also, it gives you a backup if electricity fails.

Electricity ($100/month; $1,200/year)

This is higher in summer for AC. We have to have AC here as it gets very hot in the summer!

Water, garbage and recycling ($111/month; $1,332/year)

It was a big eye opener from moving from the Vancouver area where utilities (water, sewer, garbage) were included in annual property taxes. In the Kelowna area, there are additional separate quarterly utility invoices from the city.

There is a flat fee as well as a usage component. Our last quarterly invoice with a minimal charge for actual water use was $410. I would expect water usage to be more in the Kelowna area as most houses are equipped with an irrigation system.

Depending on where in the Kelowna area you live, these charges will vary, but I would say to budget at least an additional $100 a month.

Internet ($130/month; $1,560/year)

This covers our phone, TV, and internet. We call in regularly to the loyalty department and ask for additional discounts.

Home phone ($0)

This is bundled with our internet.

Cell phones ($150/month; $1,800/year)

This is for two phones with good plans on a national carrier.

Streaming entertainment ($10/month; $120/year)

We’ve occasionally tried other services like Disney+ for Spring Break, but just for a month and then cancelled.

5. How much do other essentials cost in Kelowna?

Life and disability insurance ($46/month; $552/year)

We have life insurance but no disability insurance. Especially with our net worth increasing, we may switch to self-insurance soon. (That is, pay the premium I used to pay into a separate account.)

Medical insurance ($0)

While basic medical is free in Canada, things like dental and prescriptions are not. These expenses are usually covered by extended health plans through employment or paid personally.

We choose to pay cash out-of-pocket instead of paying for a plan. We also use some government programs for the kids’ expenses.

Out-of-pocket medical expenses ($200/month; $2,400/year)

This is for dental, prescriptions, etc. We pay for these expenses almost 100% out-of-pocket. Really, we only have costs for prescriptions (my wife has some medical issues) and the occasional dental cleaning.

BC Healthy Kids covered a bunch of the dental costs in the last few years, but as our household income has risen we will lose these and additional government benefits (such as the CCB).

Clothing and footwear ($300/month; $3,600/year)

This is mostly for the kiddos who are growing like weeds. We try to pass hand-me-downs from older brother to younger, but younger is getting picky!

Personal care ($300/month; $3,600/year)

This category includes: haircuts, toiletries and grooming services and supplies.

We include this category with miscellaneous and gifts. This covers birthday gifts. Let me tell you there is always a birthday or holiday around every corner…

Technology ($0)

This category includes essential technology: software and hardware purchases, upgrades, maintenance, and repairs. Non-essentials (video games and consoles, e-readers, security cameras, etc.) aren’t included.

None.

Part 3: Adding it all up

Now that we’ve detailed all of Chris’s essential expenses, it’s time to add everything up in some nice, organized tables!

Important notes about the numbers

- Only essential expenses are included.

- Discretionary expenses (e.g. travel, gifts, etc.) are not included.

- Expenses are rounded to the nearest dollar.

- Expenses are displayed in the interviewee’s home currency.

- In this interview, the home currency is Canadian dollars.

- For your convenience, I’ve included a currency converter in each section. I hope you find it useful!

For detailed explanations about which expenses are included (or not) see my How Much Does it Cost to Live the FIRE Life intro post.

How much does it cost to live the FIRE life in Kelowna?

1. Housing

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Mortgage | $1,424 | $17,088 |

| Property tax | $177 | $2,124 |

| Strata/HOA fees | $0 | $0 |

| Home insurance | $97 | $1,164 |

| Maintenance | $21 | $252 |

| TOTAL | $1,719 (with mortgage) $295 (no mortgage) | $20,628 (with mortgage) $3,540 (no mortgage) |

Home equity opportunity cost: $27,442/year

2. Transportation

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Vehicle loan | $600 | $7,200 |

| Vehicle insurance | $300 | $3,600 |

| Gas | $350 | $4,200 |

| Vehicle maintenance | $50 | $600 |

| Bike maintenance | $0 | $0 |

| Parking and tolls | $0 | $0 |

| Transit | $0 | $0 |

| TOTAL | $1,300 | $15,600 |

3. Food

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Groceries | $800 | $9,600 |

| Eating out | $350 | $4,200 |

| TOTAL | $1,150 | $13,800 |

4. Utilities and bills

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Natural gas | $100 | $1,200 |

| Electricity | $100 | $1,200 |

| Water, garbage and recycling | $111 | $1,332 |

| Internet, home phone and cable | $130 | $1,560 |

| Cell phones | $150 | $1,800 |

| Streaming entertainment | $10 | $120 |

| TOTAL | $601 | $7,212 |

5. Other essentials

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Life and disability insurance | $46 | $552 |

| Medical insurance | $0 | $0 |

| Out-of-pocket medical expenses | $200 | $2,400 |

| Clothing and footwear | $300 | $3,600 |

| Personal care | $300 | $3,600 |

| Technology | $0 | $0 |

| TOTAL | $846 | $10,152 |

Grand totals

| Expense | Monthly (CAD) | Annual (CAD) |

|---|---|---|

| Housing | $1,719 (with mortgage) $295 (no mortgage) | $20,628 (with mortgage) $3,540 (no mortgage) |

| Transportation | $1,300 | $15,600 |

| Food | $1,150 | $13,800 |

| Utilities and bills | $601 | $7,212 |

| Other essentials | $846 | $10,152 |

| TOTAL | $5,616 (with mortgage) $4,192 (no mortgage) | $67,392 (with mortgage) $50,304 (no mortgage) |

Part 4: Other expenses

This is a special section that’s just for fun! It’s the place for my interviewees to mention any expenses that they’ve done a really good job of optimizing and/or just want to share.

These expenses won’t be included in the totals (just to keep things as standardized as possible). I hope you find this section interesting and informative. Here are some additional expenses that Chris wanted to share:

Giving

We sponsor three children through various charities and do some giving to the local church.

Our ‘buckets’

Laura has a bucket just to spend with her and the kiddos (treats after school, etc.) This costs about $240 per month. Chris has a bucket just for his spending (lunch out at work) of about $160 per month.

Cashback rewards

We get approximately $100 in cash rewards through our Enhanced Cash Budget system and maintain a strict cash budget. We created a video to share how we do this.

Chrissy’s closing thoughts

Thank you to Chris for sharing his family’s expenses! Kelowna is one of my family’s favourite BC cities—both as a vacation destination and a home base. (If we ever decided to leave Vancouver.)

It’s such a nice size for a city; small enough to feel like a town but large enough to offer most big-city stores and amenities. It’s also a gorgeous part of the world. (Did you see that featured image? Stunning, right?) In short, Kelowna’s got a lot going for it!

I really enjoyed taking a peek into how much it costs to live in this great little city. Here are my takeaways from the interview:

Moving for affordability

Chris and Laura made a great financial choice to move from the Vancouver area to Kelowna. It’s far enough from Vancouver to make its real estate affordable, but it’s not so remote that everything else is costly.

By moving, Chris and Laura were able to buy a comfortably-sized home for the same price as a Vancouver condo. In addition, their property taxes are much lower for a similar level of infrastructure, amenities and schools.

Kelowna and small cities like it are a fantastic sweet spot. You get most of the benefits of living in a large city (good jobs, lots of stores and services, high standard of living). But you also get the huge advantage of significantly cheaper housing costs.

Putting home equity to work

Chris and Laura use the Smith Manoeuvre to unlock their home equity and invest it. I have no doubt that this measurably reduces their timeline to FIRE.

I’m a huge fan of the Smith Manoeuvre and wish my husband and I had used it from day one. It’s a powerful way to take advantage of real estate appreciation and make use of the equity you’ve built in your home.

If you’d like to learn more about the Smith Manoeuvre, my co-hosts and I cover it on our podcast, Explore FI Canada:

That car lease!

Staying true to his policy of complete transparency, Chris unabashedly reveals his only financial concern—their car lease! It’s admittedly not cheap… and it’s for a rather large, pricey vehicle.

However, I think there’s value in Chris’s open sharing of this expense. To start, it shows that FIRE seekers are only human. We don’t always make the most optimal choices. It also shows that we can still be happy with our less-than-perfect financial decisions. (Chris loves the vehicle!)

Finally, Chris and Laura are still putting away a lot of money—both in mortgage prepayments and investment contributions. When you save a high percentage of your income, you can still get ahead, even with some high expenses.

Out-of-pocket medical expenses

Chris is my first Canadian interviewee who pays completely out-of-pocket for extended health expenses (dental, prescriptions, etc.) Most Canadians are covered for these expenses (at least in part) by an employer-subsidized group plan.

But post-FIRE, we’ll need to budget for these expenses when we lose our coverage. That’s why it’s helpful for Canadians on the FIRE path to see how much Chris’s family spends on medical costs—even if it’s only for a rough estimate.

Conclusion

Chris and Laura did what my husband and I decided not to do—they moved from a high cost of living area to an area with moderate living costs. This single decision has likely shaved a decade or more off of their FIRE plans.

They chose their new hometown wisely, and have lost little or nothing in their standard of living. In fact, I think they gained a higher standard of living by moving to Kelowna. Since it’s a small city, crime rates are lower, traffic is lighter and the lower expenses allow them to spend and save more.

It’s not hard to see the appeal of a move like that! If not for our large extended family all living in Vancouver, we’d seriously consider moving to Kelowna. If you’ve never visited, I can almost guarantee you’ll fall in love with it. It’s a beautiful little city.

Chris and Laura—kudos to you for all the wise financial decisions you’ve made so far. You’re on a great path. I look forward to continuing to follow your progress towards FIRE!

Share your thoughts

Were you surprised by Chris’s essential expenses? Are any of them significantly different from where you live? Share your thoughts in the comments, along with your own money saving tips!

Have you ever wondered how much it costs to live in Warren Buffet’s hometown? Well, now you can find out! Jonathan shares how much it costs his family to live in Omaha, NE.

The San Francisco Bay Area is known as the most expensive area to live in the US… but does that hold true for optimized FIREees? Find out as John reveals his spending in this interview!

Visit the intro page to learn more about the what and why behind the series and access the complete list of interviews.

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

4 Comments

Denise

September 1, 2021 at 10:54 amIs there an FI group for Kelowna? I didn’t find one on Facebook!

Chrissy

September 1, 2021 at 1:46 pmHi Denise—unfortunately, I don’t believe there’s a Kelowna group. People who live in BC just join the Vancouver group by default because it’s the closest one. We even have a few people joining from Washington State for the same reason!

Teresa

September 9, 2021 at 10:22 amThis certainly is an eye-opener for me because I always thought it was much cheaper to live in a smaller town/city. From what I see in Chris’ expenses, the only items that are lower are housing and property taxes. The rest of the expenses are in line with what we pay living in Vancouver.

Chrissy

September 9, 2021 at 4:56 pmHi Mom—this has been the most eye-opening observation for me in doing this series. I never expected that non-housing costs would be the same or more in smaller, lower-cost areas. Seeing the numbers has made me realize that the lower costs largely come down to housing.