Photo by Danny Gallegos on Unsplash

FIRE under fire

I’ve said it before, and I’ll say it again: I have the best in-laws ever! I’ve spoken fondly of them often—including in my summer update (in which I mentioned how easy it was to live with them in their RV for three weeks)!

From the beginning of our FIRE journey, one of our biggest cheerleaders has been my mother-in-law. She’s always been nothing but supportive, encouraging, and enthusiastic about our pursuit of FIRE.

But when it came time for my husband M to actually retire, both of his parents had questions for us! 😬 Suddenly, FIRE was no longer a far-off, hypothetical scenario. It was really happening, and it prompted them to voice their concerns about M retiring early.

Justified concerns

Like any caring parent, M’s mom and dad wanted to ensure we had our bases covered. Their concerns were justified, and we’re glad they felt comfortable enough to put our feet to the fire.

After all, M’s early retirement was one of the most significant decisions of our lives. If we got it wrong, the consequences could be disastrous and life-altering.

So, when M said he was going to quit his job and his parents expressed concern, we encouraged them to go ahead and question us. We were more than happy to address their worries and assuage their fears.

Also, it was another opportunity for me to run through our plans and ensure we were covered for every eventuality. (My regular readers know I’ve always done this—I make emergency plans because that’s more effective than holding a generic emergency fund.)

Ask us anything

I asked my in-laws to question us about every possible issue and concern they could think of… and they aced the assignment! Below, I’ve shared our email conversation (lightly edited for clarity)—with all their questions and all my replies.

As you’ll see, M’s parents didn’t hold back! They got very detailed and specific about their concerns, and I’m glad they did. For one thing, it was an excellent opportunity to stress test our FIRE plans.

For another, I wanted M’s parents to feel fully at ease with us FIREing. I didn’t want them losing sleep worrying about us, so I was happy to lay everything out for them to see and understand.

Why I’m sharing our private conversation

Why am I sharing this private conversation between my in-laws and me? Well, like everything I share here on the blog, I want to help others on the FIRE path. If I’ve experienced something in my FIRE journey, maybe you have too.

Perhaps, by sharing my experience, you’ll find new ways to talk about FIRE with your family and friends. Or maybe you’ll take away ideas to add to your own FIRE plans.

For others still, it may just be a voyeuristic peek into my life and my relationship with my in-laws! Whatever the case, I hope you find our email exchange helpful (or entertaining).

Note: My in-laws gave me permission to share our email conversation. 🙂 Also, this email thread was from mid-2021, before M retired. Therefore, some info and references may be outdated.

My in-laws grill us on our FIRE plans

To help make the email a little easier to read, I’ve broken it up into two posts and into sub-sections. (Part 2 is coming next week!)

Part 1 (this post)

Part 2 (next week)

With that, let’s get started with Part 1…

Intro

In-laws: We put this email together after reading the article that M sent last week. It does cover many issues that dad & I are concerned about, and we are happy to see you are looking into it with eyes wide open rather than just seeing the positive side only.

Chrissy: Absolutely. I know it appears we’re only looking at the positives. But we have, in fact, put a lot of time into discussing and planning for potential downsides.

I’ll go through each of your points in my reply and hopefully reassure you that we’ve done our best to think of everything.

Cash versus stocks

In-laws: We do understand that we have never known much about the financial markets and appreciate all the effort from Chrissy to educate us and help us so that we are more diversified and getting more return on our investments rather than GICs. We are old-fashioned and still believe in having cash on hand and a home that is paid for.

Chrissy: You’re neither old-fashioned nor alone in your beliefs. There are people our age or younger who feel the same way as you. Personal finance has a strong psychological component, and most people feel better with more cash and a paid-off home.

There’s nothing wrong with this. In fact, it’s wise to manage your money with your psychological needs in mind. Going against that could result in fear, panic, and undue worry. This could then cause you to sell your investments at the wrong time.

It’s better for each individual to know themselves and invest as it suits their goals, timeline, and personal money psychology. Personally, I take comfort in detailed math, extensive planning, reliable data, and professional guidance. All those factors lead us to feel better about:

- Holding less cash (because cash won’t survive the ravages of inflation).

- Putting our home equity to work (because it helped us reach retirement sooner and is a powerful way to turn Vancouver’s expensive real estate into an advantage).

This isn’t to say there’s a right or wrong approach—it all depends on each individual’s situation. We just have to know which tactics suit us best and then learn how to use them safely and effectively.

In-laws: Right now, it is the financial markets that are gaining because no one wants cash making almost 0% interest. Things go in cycles—who knows when the cycle will change again, and markets do poorly, and cash will give a higher return?

Chrissy: It’s true; our investments will never be up all the time. There will always be market cycles, and all investors must be prepared for bad times to eventually arrive.

Related: Did We Retire at the Worst Possible Time?

We plan to implement a flexible withdrawal strategy to mitigate the risk of drawing too much in bad times. Here’s how it would work:

- If stock returns are excellent, we’ll withdraw more and splurge on big-ticket items (a big trip, replacement vehicle, new roof, renovations, etc.)

- If returns are okay, we’ll spend like we normally do, plus a few extras.

- If stocks drop a little, we’ll scale down or cut out travel and large purchases.

- If stocks drop a lot, we’ll cut out all travel and most extras.

To be honest, I can’t see us ever facing a scenario where we’d need to cut down to barebones spending, but that’s another option if needed.

Flexible spending will go a long way in sustaining our portfolio and income for life. In addition, we could bring in income by hosting students, working part-time, or picking up freelance design jobs. These measures will be more than enough to sustain us through even the worst markets.

However, note that this is all based on sound retirement research—not just my assumptions! Michael Kitces is a well-known retirement researcher who has done a lot of work on flexible spending strategies.

In this article, he discusses how small changes (such as earning a small amount of income in retirement) can, 90% of the time, result in a much bigger nest egg than what a retiree started with: The Problem With FIREing At 4% And The Need For Flexible Spending Rules.

In-laws: We think having some cash, financial market investments, and real estate is the safest way because all our eggs are not in one basket. Never in my wildest dreams did I think interest on my money would be less than 1%!!!

I am just worried that it can be the same with the financial markets. Everyone kept predicting that the housing prices would crash for decades, but it’s only now started to cool—so who can predict anything 100% correctly.

Chrissy: You’re right; no one can predict what will happen. This is why we have a detailed plan that covers us for a wide variety of scenarios. It’s also why our investments are well diversified into thousands of companies and some real estate (our home*).

*See the box below for why I see our home as an investment—despite this being a controversial viewpoint.

As for my thoughts on cash: we’ll likely keep more cash on hand once M stops working. However, based on historical data and much research, there’s a much higher chance that we’ll run out of money when holding more cash. Therefore, we’ll keep a reasonable amount of cash, but not so much that it would hurt us in the long run.

As for stocks earning only 1%, that could happen in the short term (1–5 years). However, it rarely happens over the long term (5–10 years) and never over the very long term (20+ years).

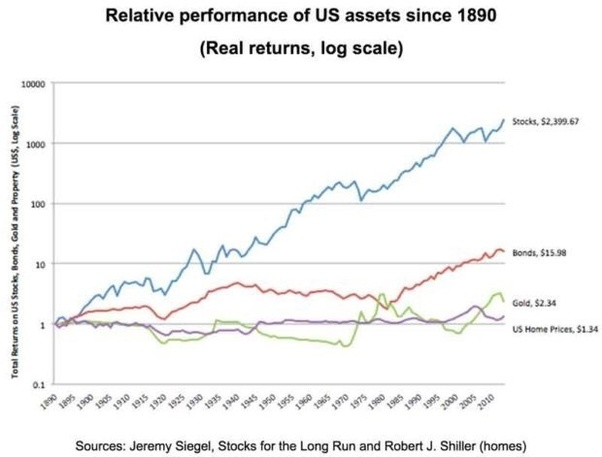

I know that stocks can seem scary because of their short-term unpredictability. But when you zoom out and look at the long term, you can see they FAR outperform cash, bonds, and inflation:

Stocks versus bonds, gold, and US home prices

Chrissy: So, while there’s no predicting what the markets could do, the best guess we can make is based on historical evidence. And the evidence shows that stocks do far better than 1% over the long term.

Can your home be an investment?

I know many people would disagree about our home being an investment. They’re not wrong—most homes only appreciate enough to keep up with inflation. In addition, a home that you live in is really more of a consumption item than it is an investment.

However, I still see our home as an investment because:

- We pulled out our home equity to invest in stocks.

- We live in Vancouver and expect, over the long term, to see continued appreciation that’s higher than inflation. (This is based on expert opinion—such as this—which I follow to keep tabs on the Vancouver market.)

Whether you agree or disagree, feel free to share your thoughts on this in the comments!

Financial ‘advisors’

In-laws: We’ve heard of people who had a trusted financial advisor and did well when the market was up, then crashed with everyone else. I still don’t think they’ve recovered from the 2008 crash. Where were the good advisors to guide people like that? This is why we never really trusted anyone to help us invest.

Chrissy: It’s terrible what happened to those people. Unfortunately, ‘financial advisor’ isn’t a regulated title or credential (at least not yet). Therefore, many who claim to be ‘advisors’ are little more than salespeople.

These ‘advisors’ earn commissions from selling investment products to their clients—all while providing poor or very little advice. Due to the commission structure, they may be incentivized to sell investments that may not be in the best interests of their clients.

Sadly, it sounds like the people you knew probably weren’t working with qualified, well-trained advisors. However, there are good advisors/planners out there. The gold standard to look for is someone with the CFP certification.

The financial planner we work with is a CFP and charges on a fee-for-service model. That means his fees are for services he provides (e.g. financial planning, investment management, retirement planning, etc.)—instead of commissions for selling investments.

This isn’t to say that working with a financial planner is for everyone—it’s not. But there’s definitely a place for qualified, skilled financial advisors. You just have to know what to look for!

In-laws: Maybe if we had been educated on how to invest in the markets, we could have made lots of money from it. Our generation relied on advice from businesses like Edward Jones, Merrill Lynch, Canaccord, Odlum Brown, etc. We know of no one that has become rich or even comfortable financially investing that way.

Chrissy: Yes, you definitely would’ve done even better if you’d been properly invested (and advised) from the start. But you and dad still did very well with your money, largely because you’re such amazing savers. (And also because you listened, learned, and changed when I nudged you towards better investments and advisors!)

Smith Manoeuvre worries

In-laws: Even though we knew about the Smith Manoeuvre, as realtors, we never knew when and where the next cheque was coming from, so it was way too scary for us to mortgage and invest. It is different for you guys since M has a steady income and is well situated in his job.

Chrissy: I think you made the right decision to avoid the Smith Manoeuvre. It’s definitely not for everyone. (In fact, I think it’s unsuitable for most people.)

If owing money keeps you up at night or, as you mentioned, your income isn’t consistent, it’s probably not the best strategy for your situation. You’re also right that our situation is very different from yours.

Before we started leveraged investing, we carefully weighed all the pros and cons. Our financial planner also did a detailed analysis of our cash flow and finances to see if it was safe for us to use the Smith Manoeuvre.

In addition, he ensured we had multiple ways to keep the loan payments going, no matter what happens, BEFORE we implemented anything.

This is why I feel it’s so important to have professional help with the Smith Manoeuvre. 90% of people shouldn’t even consider it, even with help. And of the ones who do use the Smith Manoeuvre, most shouldn’t do it without professional help!

In-laws: Here is something that helps to give us our comfort level—we have always been told to pay off our mortgage ASAP, so our house is one thing no one can ever take away from us. We didn’t use the Smith Manoeuvre because we always believed that as long as we own our home, no one can ever take it away from us.

Chrissy: Most people hold the same beliefs as you and are not wrong. But to put your mind at ease, no one can take our house from us either! Here are some common concerns about the Smith Manoeuvre/leveraged investing and how we are covered for them:

1) What if the bank “calls” your loan?

When a loan is “called”, it means that the lender can demand, without notice, that you pay back the amount owing on your loan. They can then also decrease or eliminate your credit limit. Considering the amount we’ve borrowed, that sounds pretty scary!

Fortunately, we’re at very low risk for this because even though they’re technically allowed to, banks haven’t been known to call HELOCs in Canada—not even during the housing crash in the 90s. They may reduce your available credit, but they usually won’t unless you’ve missed payments or been otherwise delinquent.

Also, while our bank could call our HELOC, they can’t call our mortgage unless we breach the terms of our mortgage. Most of our borrowing is in the mortgage portion of what we’ve borrowed. Very little is in the HELOC portion, so we’re quite safe.

In addition, we’re always on time with our payments and have the funds to continue making our payments for as long as needed. Finally, we’ve thoroughly assessed all these risks with our financial planner and his team.

They have decades of experience using leverage (especially mortgages and HELOCs) to invest. They know and understand all the legal and tax rules, how mortgages work, what banks will or won’t do, etc.

Our financial planner and his team have educated us and built our financial plan to address and mitigate any risks. Therefore, I’m confident we’ll have no issues with our HELOC or mortgage ever being called.

2) What if the markets crash?

The concern is that if the markets crash, we won’t have enough investment income to make our loan payments. This is yet another scary scenario, but once again, we planned ahead for this.

When working out our retirement and overall financial plan, our financial planner and his team used conservative numbers:

- A much higher mortgage rate.

- Higher inflation.

- Lower returns.

Then, we not only saved enough to cover the larger amount needed to account for those factors but also added an extra buffer on top of that. Therefore, even if there’s a crash, we’ll still be able to make our payments—without affecting the long-term sustainability of our portfolio.

3) What if we’re “underwater” with our loan?

Being “underwater” with our loan could mean two things with the Smith Manoeuvre:

- The value of our house drops and is worth less than what we owe.

- The investments we made with our borrowed money are worth less than what we owe.

In situation 1, that’s highly unlikely, given that we live in Vancouver. And, even if our home value were to drop that low, our bank won’t call our HELOC or reduce our credit unless we’ve been delinquent.

In situation 2, the bank doesn’t know anything about our investments, so they wouldn’t know that we were underwater. Regardless, we’d only be in trouble if we sold most or all of our investments when they’re down.

As long as we don’t sell (and we keep making our mortgage payments), it wouldn’t matter that we were underwater. We’re invested and leveraged for the long term, and the markets and our investments will go back up again. Being underwater would just be a temporary non-issue.

4) What if interest rates go up?

If interest rates went up to 12% or more (like they did in the 80s), we’d be in trouble! But that’s highly unlikely. More realistically, if they went up to 4 or 5%, we’ve accounted for that in our plan.

Even so, rate increases won’t affect us much until we renew our mortgage. But that’s a few years away. As a worst-case backup to help lower our payments, we could pay down some of our mortgage (using our leveraged investments).

5) What if you can’t renew your mortgage in retirement?

As most people know, banks look at everything before approving you for a mortgage. Naturally, many worry that once they retire and no longer have a job and employment income, they won’t be able to borrow as much.

Again, I’m not concerned about this because I checked with our financial planner and his team. They told us that as long as we don’t change our lender or the terms of our borrowing, we should have no issues renewing our mortgage. (This is true even if our employment situation has changed, e.g. M retiring.)

I hope that helps you to better understand how our leveraged investing works and that we (and our house) are safe! Let me know if you have more questions.

To be continued…

As mentioned, I’ve decided to break up my email conversation with my in-laws into two posts. (As a single post, it was clocking in at 8,000 words!!!) As riveting as this conversation may be, I’ll have to keep you in suspense until next week. 😉

Check back in for Part 2, in which I’ll cover:

- Why not keep working?

- Living too long

- Healthcare concerns

- Worst case scenarios

- Closing thoughts

Share your thoughts

Do you agree with my in-laws’ worries and skepticism? Have you wondered about some of the same things? What about your family and friends—have they also expressed concerns about your FIRE plans?

Also, let me know if I’ve missed anything or if there’s anything you want to know more about. I’m open to questions about our FIRE plans and would love your feedback—leave a comment below!

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

16 Comments

Liquid Independence

September 21, 2022 at 9:58 amYour in-laws brought up some pretty valid points. But you’ve clearly thought them through with your FP and husband. I don’t think you’ve left any stones unturned. It’s funny that GICs were brought up. For the first time in like a decade the nominal returns are actually not bad. Some GIC rates are getting close to a 5%/year. 🙂 But I still prefer stocks, bonds, and options, lol.

All that being said, at the end of the day the real risk is what remains after you’ve considered everything. By definition you can’t plan for a black swan event. So the best solution is to be flexible going forward, which you certainly seem to be. 😁

I’m looking forward to part 2.

Chrissy

September 22, 2022 at 10:09 pmHi Liquid—I haven’t been paying attention to GICs. Wow, 5%/year? That’s unbelievable! Even so, I’m the same as you and still prefer stocks (and maybe options, if I ever learned how to trade them 😉).

You’re absolutely right about the black swans. I know there are people who can’t sleep unless they do something/anything to mitigate the risks for those types of events. I’m a worrier by nature, so I have to be careful about not letting myself go too far down those rabbit holes!

Teresa

September 23, 2022 at 4:07 pmIt was hard for us to let go of GICs because we used to get between 11% – 14% on all our GICs so we felt it was really safe for us. We were also very successful investing in real estate by buying, fixing and selling our principal residence.

That is a bygone era for sure. The recent 2 decades were really painful for us to watch our money shrink because the interest rates were rock bottom but luckily Chrissy guided us out of the abyss and put us back on firm ground! For us to sleep well, we still have more cash on hand than we should. Takes time to teach an old dog new tricks 🙂

Chrissy

September 24, 2022 at 11:04 pmHi Mom—I know they existed, but I still can’t believe GICs used to pay 11–14%! That seems completely crazy! (But then again, so were the mortgage rates that were in the same range.)

I can understand why you were such staunch believers in the value of real estate. Your sweat equity helped you to get ahead in your early years. I only wish it was possible to repeat your successes in today’s market!

I’m relieved that you were willing to be open-minded to new ways to grow your wealth, even though it was scary to take that plunge and move your money. Yes, it takes time to teach an old dog new tricks, but at least you were even willing to consider new approaches! Some people won’t even get to that point. 😕

Court @ Modern FImily

September 23, 2022 at 7:09 pmThank you Chrissy for sharing this conversation with your in-laws! I think they brought up some very valid questions/concerns. You clearly have done ample research on how to tackle all the one-offs that may arise. I think that’s part of the FIRE culture – we are optimizers, thinkers, planners, etc – deciding to retire early is not some ho-hum decision. It takes years of diligent saving, sound investing, proper planning and decision making on when to pull the plug!

Chrissy

September 24, 2022 at 11:09 pmHi Court—I’d told you I was going to share this email with you, but I never got around to it until now, ha ha! I’m glad you were finally able to read it.

Thanks so much for sharing your feedback. It’s always helpful and interesting to get your two cents on matters like this! You’re absolutely right that this near-obsessive level of thinking and planning is part of the FIRE culture. It’s a shame that more people aren’t taught to think about their finances like this. So many of them could become financially secure and independent much earlier. That’s why I’ll keep spreading the FIRE whenever I can!

Jim

September 27, 2022 at 3:04 pmGood post but i think your future real estate pricing assumptions are very risky. High prices (Vancouver) mean higher risk of a decline to the average than other markets. The conclusion below from your ‘expert’ (hugely conflicted, by the way) is completely wrong that higher interest rates won’t have an impact. New buyers will have to quality at 7% or even higher rates – meaning all real estate will be unaffordable. So prices will have to come down for them to be able to buy. A few “forced” sales (divorces, unemployment) will cause prices to crash.

Are low interest rates affecting the housing market?

“Low interest rates aren’t really a factor because the stress test has everyone qualifying between 4.79-5.25%. Everyone who is buying is having to qualify at this higher stress test rate, compared to today’s low rates. So today’s low rates aren’t letting anybody borrow anymore money at all. The stress test cut the average Canadian household’s borrowing capacity by 35%.”

Chrissy

September 27, 2022 at 10:00 pmHi Jim—you make some excellent points and I’m glad you brought them up. Yes, you’re right that the higher Vancouver’s home prices go, the harder (and farther) we can fall. You’re also correct that the interview I shared with Dustan Woodhouse is outdated.

What he said was based on what we all knew at the time (and for many years): interest rates were ridiculously low, and it seemed they’d never increase. Clearly, the current rate environment has proven otherwise, and we’d all be wise to be prepared for higher (possibly much higher) interest rates.

I concede that I take a more optimistic view of Vancouver real estate (and the world in general ) than most. However, I must disagree that my real estate assumptions are risky. That’s because our plans are based on the very long-term (25+ years). Also, our plan does not factor in the sale of our house. That would essentially be a bonus for us or an inheritance for our kids.

We don’t plan to sell our house anytime soon, and are prepared with multiple contingencies should rates increase to an uncomfortable or unsustainable amount. Therefore, I don’t see how falling real estate prices could affect our plans much as long as we don’t sell our house.

I’m no expert though, so feel free to enlighten me if I’m missing something here!

Tina

September 29, 2022 at 2:04 amVery interesting read. Thank you for sharing. I’m wondering if your plan also includes scenarios such as serious illness, divorce and so on?

For example you write that you can always go back to work. What if you can’t? What if one of you get a serious illness or injury and needs constant care? Here in Denmark we don’t have to worry about the cost of care as that is covered by our taxes. I don’t know about Canada. But one thing is cost and another is the implications these life events will have on all plans.

I do believe in thinking these scenarios through but not obsessing over them. We have to live, right?

Again thanks.

Chrissy

September 29, 2022 at 9:21 pmHi Tina—excellent questions! I do address serious illness in Part 2, which I just published yesterday: That Time My In-Laws Grilled Us On Our FIRE Plans (Part 2) As in Denmark, we’re also fortunate in Canada that we’re covered for most of our medical care. For expenses that aren’t covered (dental, prescriptions, massage, physio, vision care, psychology, etc.), we’ve included them in our planning.

As for divorce, I wrote a very long comment about it in an FI Facebook group I’m in. Here it is (sorry, it’s a bit of a novel!)

This would be a BRUTAL cost to account for. Divorce is one of the most financially-devastating (not to mention emotionally devastating) scenarios out there. In Fred Vetesse’s book (Retirement Income for Life) he says that you only save 30% on living costs when living as a single versus a couple. So, you’d need 140% of what you currently have in order to support two households. That’s quite a bit more.

Tanya Hester and her husband (from the blog, Our Next Life) planned for this scenario and saved up enough to be FI as individuals. As far as I know, they’re the only ones who have shared publicly that they’ve planned for this scenario. I know that “things” can and do happen out of the blue… but I would think that the risk of a relationship breakdown could be mitigated by investing plenty of time, attention, care and, if needed, therapy, into the relationship—long before problems appear.

Personally, this is what my husband and I do. We’re both well aware of the financial devastation that divorce can cause, and neither of us is willing to endure that, after so many decades of hard work building what we have together. It only makes sense to “invest” in the marriage with all the time we can give it, in order to prevent the risks to our financial health.

So, while we aren’t planning to save enough to cover two households, we are planning to invest time (and money for therapy, if needed) into the marriage—both pre and post FI.

You’re absolutely right that we do need to think these scenarios through, but not obsess over them. That’s such a succinct way to explain the balance! Thank you so much for reading and taking the time to comment. I hope that Part 2 helps to answer your questions about serious illness.

Carolyn M

October 3, 2022 at 7:42 amMy Mom is always worried about my plans to retire this year and I’m 57 and a CPA! So believe me I have crunched numbers and have a safety net with the farm I own. But I don’t mind the questions,you never know when there is something that you might have missed.

Chrissy

October 3, 2022 at 5:04 pmHi Carolyn—it seems we are our parents’ children forever, no matter how old we are! It’s a lovely thing to have parents who care so much and us, isn’t it?

You’re absolutely right that questions can be a good thing. All of us have blind spots, so it can be helpful to get a second opinion.

Thanks so much for reading and commenting!

Kris O'Grady

October 3, 2022 at 9:44 amI am in my 50’s and seeing many divorces and how it impacts folks financially. If you leave the workforce and retire and one of you has a mid-life crisis and decides that divorcing and going with someone 15 yrs younger is the plan, then what if you are retired? (it seems to be happening to at least 1in 4 of my friends and often the most financially stable ones as they feel more inclined to act on the mid-life crisis-lol). Also, I have had a family member recently lose a husband due to sudden heart attack at an early age. What then if you are retired? Do you have to try and enter back into the workforce and lose all of the time you built up your career?

Chrissy

October 3, 2022 at 5:26 pmHi Kris—you’re the second commenter to mention divorce… I may need to add an addendum to address that! I’ve heard that “grey divorces” are on the rise, so your observations are correct. (BTW, that’s such an interesting observation that the more well-off friends are more inclined to act on their mid-life crises. I think you’re right!)

Divorce is a risk for sure, and it’s something every retiree should consider in their own plans. I’ve admittedly not added extra savings to account for a divorce. However, I have taken some time to think through the financial and logistical implications.

It wouldn’t be pretty—my husband and I would likely both have to unretire. But hopefully, we’d still be young enough to find interesting, enjoyable jobs to get us to traditional retirement.

As for the death of one partner, you’re right that it could be financially ruinous if the surviving partner needed their partner’s pension or government benefits. Often, those benefits are greatly reduced or cut altogether upon death.

However, for couples where there isn’t a pension or other income that’s tied to either partner being alive, I would think the survivor would come out ahead. That’s because they would end up with enough income for two people, but only have one person (themselves) to support.

Anyway, my reply is getting ridiculously long, so I’ll end it here by saying: this is another good reminder that personal finance is personal! It’s critical for each of us to assess our own unique risks and plan accordingly.

You’ve brought up some excellent points that I hope my other readers will apply to their own situations. Thank you for taking the time to share your thoughts!

Bob Wen

December 26, 2022 at 12:56 pmMy favourite paragraph: “ln-laws: Right now [2021], it is the financial markets that are gaining because no one wants cash making almost 0% interest. Things go in cycles—who knows when the cycle will change again, and markets do poorly, and cash will give a higher return?”

Wow, really wow! Who knew it would happen just as they said it would, and so quickly too. When you’ve been around awhile you see the cycles come and go, like flared jeans and records.

Chrissy

December 27, 2022 at 7:26 pmHi Bob—wow is right! Who knew, when my in-laws sent that email, how accurate their comments would be. And yes, flared jeans and records have also made a comeback, ha ha. There are definitely cycles that are only observable over a long time frame.