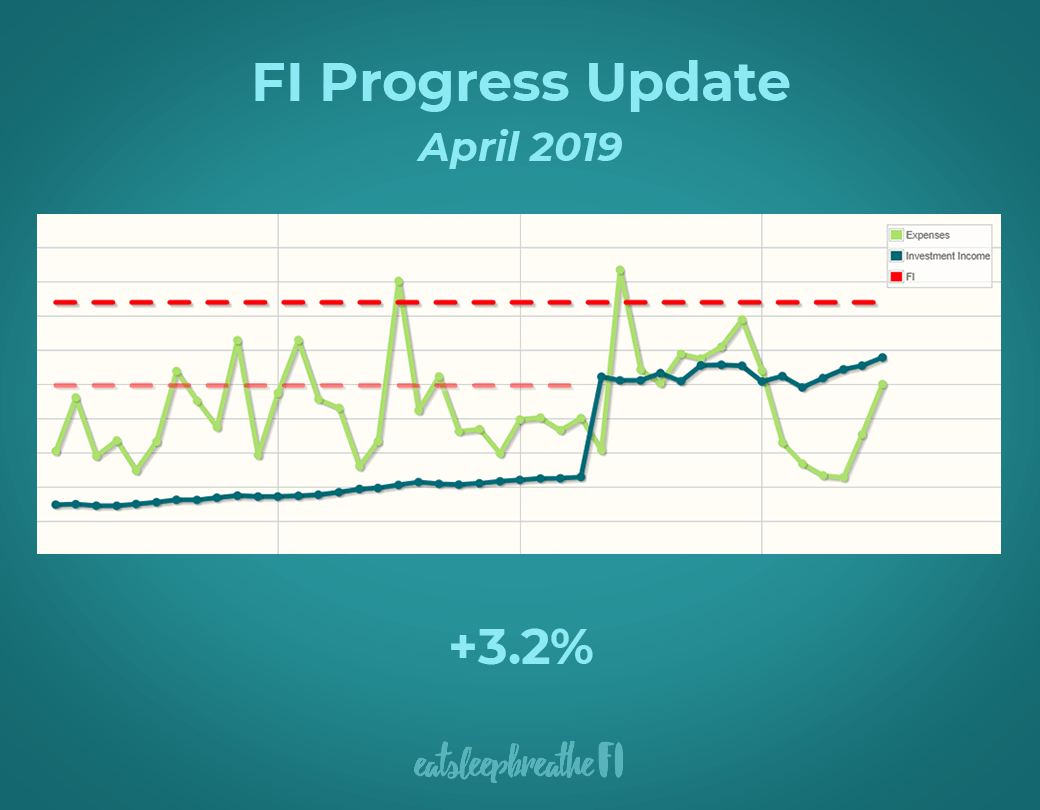

- I generated the chart using the Mad Fientist FI Tracker. It’s an amazing tool that digitizes the wall chart from the book Your Money or Your Life.

- Time scale: Each dot represents one month (the first dot is from November 2015).

- Light green line: Our monthly expenses. As you can see, our expenses fluctuate a lot from month-to-month. (This used to be challenging for me to deal with, but thanks to YNAB, those crazy gyrations no longer faze me.)

- Teal-coloured line: How much monthly income our current investment holdings would give us (based on the 4% rule).

- Bright red line: Our FI number. This amount will cover all our expenses, PLUS monthly payments for our investment loan.

- Faded red line: Our old FI number. This was the amount we were aiming for before we started investing with leverage. As you can see, we now need a significantly higher FI number. BUT the investment loan still got us closer to our goal.

- Percentage at the bottom: How much our investments increased or decreased compared to the previous month.

- If I was 100% anonymous, I’d happily reveal all. But I’m only semi-anonymous, so I’d prefer to keep our numbers under wraps.

- M loves his job and plans to continue working even after we reach FI. Revealing our net worth could give people the wrong idea and jeopardize his career options.

- I’m lazy, and math isn’t my strong suit! Reporting my numbers accurately each month would be time-consuming and I’d constantly worry that I’ll make a mistake.

Welcome to my first-ever FI progress update!

In my previous post, I wrote about my reluctance to post any sort of net worth/spending updates. In the end, I had a change of heart, and will now be posting monthly FI progress updates!

Below is my update for April. Let me know what you think, and if there’s anything I can change to make future updates more helpful or interesting.

Our expenses were a little high

In February, M and I each applied for a BMO Air Miles World Elite Mastercard. In order to receive the 3,000 Air Mile sign-up bonus we had to meet the minimum spend of $3,000 on each card by the end of April.

We’d already spent $1,000 on each card by using them to pay for some of our Korea trip expenses. But we had to put another $2,000 on each card to hit the $3,000 minimum spend.

This was easily taken care of by prepaying $2,000 for our property taxes (through Paytm) and renewing the insurance for my Mazda 5 ($1,854—yikes).

These large expenses are the reason behind the spike in our expenses this month. (Painful, but necessary.)

Note: We also received four free lounge passes with the Mastercards—a $27 US value per pass! We used them to access the Matina Lounge in Incheon airport on our way home from Korea. Unfortunately, I was pretty disappointed with the experience. The lounge was really far from our gate, crowded, and the food was only so-so.

Our investments went up

The increase in our investments was mostly from stock market gains. But it was also the result of a huge cash infusion from M’s tax refund (more on this below).

We received a massive tax refund

M’s tax refunds are usually in the low four-figure range. But this year, his refund was about seven times that!

This ridiculously huge refund was planned-for and the result of our leveraged investing* strategy. To explain further: when you invest using leverage, you can deduct your interest payments from any income the investments earn.

After that, if there’s still interest credit left, you can deduct it from your earned income. Since we invest for minimal dividends (don’t hate me, dividend investors!) there wasn’t much investment income to deduct against.

M’s the breadwinner in our house, so the remainder of the loan interest was deducted from his income—which resulted in a very nice refund.

We maxed out our retirement accounts

As soon as that gargantuan refund hit our account, I immediately transferred it into my Spousal RRSP and both our TFSAs—maxing out all three accounts for 2019! Phew, it’s nice to get that done and out of the way.

Note: Since I don’t earn a lot of income, I can’t contribute much to my own RRSP. This could lead to a huge imbalance in my and M’s post-FI income. In an effort to even out our RRSP balances, all of M’s contributions go into my Spousal RRSP instead of his individual RRSP.

I updated our RESP contributions

During my annual check-in with our financial advisor in January, he let me know that Kid 1’s reached his lifetime max of $7,200 for government RESP grants. Oops—I wasn’t paying attention! I sent in a letter of direction this month to direct all future contributions to Kid 2 only.

I decreased our life insurance

As our investments increase, our need for life insurance decreases. So this month, I sent in forms to decrease our life insurance death benefit by 1/3. This netted us a small refund cheque for the remainder of the year, and will save us a couple of hundred dollars next year.

Fortnite money lessons

We had some major drama at our house last week when Kid 2 accidentally bought a pickaxe in Fortnite. He claims he never pressed the button and that the purchase used 800 of his V-Bucks!!!

He’d previously used up all three of his ‘accidental purchase’ refunds from Fortnite.

He was still upset at bedtime, so we had a chat about it. I started by asking him why it bothered him so much. (800 V-Bucks wasn’t a huge loss—it only cost him about $13.) He told me he was mad because his money was gone—then he started crying.

I realized then that this situation was my fault. My kid was torturing himself over $13, and it was all because of me.

The thing is, M and I talk very openly about finances in our house. We explain why we spend money on some things and not on others. Because of this, our kids have a healthy awareness of money and are careful with their spending.

But I realized that night that I can get overly focused on saving and optimizing our money. My kids see and internalize that—and it’s not necessarily balanced. I’d never realized it, but I also need to tell my kids it’s okay to not be perfect with your money. We all make mistakes, and that’s just fine. It’s how we learn.

I told Kid 2 all of this, then helped him put the $13 in perspective by reminding him how much he’d just received in birthday gifts (over $100). The $13 didn’t sting quite as much after that.

While I’m happy my kids hate wasting money, I now know I also need to work on balancing their money beliefs.

People want financial literacy in schools

In happier news, I discovered Kid 1’s current unit in Math 9 is personal finance! Naturally, I just had to tweet about it:

My oldest son is in Grade 9 math... and they have a personal finance unit!

— Chrissy @ Eat Sleep Breathe FI 🍁 (@esb_fi) 2 May 2019

It includes things like budgeting, types of bank accounts, how loans and interest work, etc.

So glad to know they're finally starting to teach kids these basic, but crucial lessons.

I posted the message thinking one or two people might see it—but it somehow became my most popular tweet to-date! (It just goes to show how desperate we all are for financial education in our schools—let’s hope this is the beginning of more to come.)

As for the content of Kid 1’s personal finance unit: it covers all the basics of personal finance, and Kid 1 actually seems to be getting it! I was such a proud mama when he eloquently explained principal and interest to me:

The principal is what you owe from the beginning, then the interest is what gets added on top.

– Kid 1

That’s a better and clearer explanation than I could’ve ever come up with!

Side note: The new BC school curriculum has been a pain for teachers to adjust to (and not everyone’s happy with the changes). But so far, I’m mostly impressed—especially with this particular math unit. It’s about time this kind of material was taught in schools.

And that’s a wrap!

April was a pretty busy month for us money-wise, but I’m expecting May to be a little quieter. What about you? How was April for you?

Support this blog

If you liked this article and want more content like this, please support this blog by sharing it! Not only does it help spread the FIRE, but it lets me know what content you find most useful. (Which encourages me to write more of it!)

You can also support this blog by visiting my recommendations page and purchasing through the links. Note that not every link is an affiliate link—some are just favourite products and services that I want to share. 🙂

As always, however you show your support for this blog—THANK YOU!

17 Comments

Freedom101_Phia

May 6, 2019 at 7:21 amHey Chrissy! I’m totally with you on the numbers front – I don’t share our specifics either, and while I’m always encouraging of people being open to financial discussions, I really don’t think that necessitates the minutia of our personal situations :). I’ve think you’ve struck a nice balance here with the details in the post!

On the K2 Fortnite front – I just wanted to say that while I completely get that it totally sucks to see our kids so upset, I also think there’s immense value in the experience you described! It’s a great, and safe space for him to make a “mistake” like that (with minimal downside), not to mention that it sounds like you handled it like a rockstar parent that provided him with a valuable opportunity to reflect, discuss, learn, and move forward with increased confidence that we all make mistakes, money and otherwise!

Chrissy

May 6, 2019 at 7:37 pmThanks Phia! It’s nice to know we’re on the same wavelength re: sharing our numbers and parenting issues!

In all honesty, I often feel like a mean mom when I let my kids feel the weight of their mistakes. But I’ve seen the damage when parents aren’t ‘mean’ enough when kids are little—and I don’t want that for my kids.

Too many parents can’t bear to see their kids ‘suffer’ and swoop in to fix things too quickly and too often. (As I’m writing this, I keep thinking of your recent article and how you address all of this so perfectly!)

I agree that it’s so important to let our kids make their mistakes, then support them through it. It’s how they’ll build problem-solving skills and lifelong resilience!

Anyway, I’ll get off my soapbox now. As always, thanks for the thoughtful comment.

Money Mechanic

May 6, 2019 at 8:10 amThere’s a silver lining to your sons’ grief over the loss of $13. While visiting relatives I learned that their son spends the majority of his allowance in Roblox(online kids game), over $50/month!!! Someone needs to have a talk about that with him. Of course, you’re right, there needs to be a healthy balance.

Chrissy

May 6, 2019 at 7:12 pmIt’s important for kids to have some control over their money, but wow—$50/month? That’s a lot! He needs a good Mustachian talking-to!

Ms. Mod

May 10, 2019 at 11:00 amNice progress Chrissy! Thanks for sharing this experience with your kiddoe, it’s sometimes surprising how much we influence them without realizing it. You’re a great mom and I’m glad you had a nice opportunity to approach the subject with him. I’ll keep it in mind as my kiddoes are getting older and gain more understanding of all of this money stuff.

Chrissy

May 11, 2019 at 6:21 amThanks for the kind words Ms. Mod. 🙂 It’s so true that we influence our kids all the time. This makes teaching money lessons easy since you don’t have to do anything ‘extra’.

But, as I’ve realized, you have to monitor what they’re actually taking away from you! (Especially if you’re a crazy money nut like me who can get a little extreme!)

Teresa

May 11, 2019 at 8:11 pmGlad the school is teaching something about finances… I sure hope they will teach all the young ones about credit cards and how the interest can grow and grow…. how high the rates are and what a loss to your budget and living with so much debt!!!

Chrissy

May 12, 2019 at 3:19 pmI sure hope so too! I also hope that the FIRE movement will continue to grow, and help basic financial knowledge like that to proliferate!

T on FIRE

May 13, 2019 at 9:42 amI’m loving this update! You’re getting close! Thank you for sharing. You’ve inspired me to plug in all my numbers to the FI calculator…let’s just say things aren’t in quite as good shape on my chart. Haha! Hopefully we’ll be moving in the right direction soon. I’d love to pick your brain about your investment loan! Obviously it needs to be low interest I would think? Looking forward to the next update 🙂

Chrissy

May 13, 2019 at 8:51 pmI love that FI calculator! It’s the only way for me to get pretty graphs of my numbers (I’m not skilled enough with Excel).

Re: the investment loan, the lower the rate, the better. But even higher rates can still work. I’ll write a proper article about this (hopefully soon). For now, here’s a note I saved from the research I did on leveraged investing:

“Studies actually show that a breakeven on leverage over the long term is an investment return of 2/3 of the interest rate. So, if you borrow at prime, for example 6%, and invest in a reasonably tax-efficient investment and make 4% long term, you will find that, after tax, you’ll break even.”

T on FIRE

May 14, 2019 at 3:39 amThank you for the details on the leverage investing. I want to investigate this option. Are the investments going into RRSPs I assume?

Chrissy

May 14, 2019 at 5:07 pmThey actually shouldn’t go into a registered account! In order to deduct the interest, you need to invest in a non-registered account.

T on FIRE

May 15, 2019 at 11:15 amGot it, thanks! That makes sense.

Kris

May 21, 2019 at 2:01 pmI feel out of touch about having no idea what is Fortnite…haha!! Is it a video game? I’m the same when people talk about Game of Thrones. Although I feel left out, I have no plans in getting into GoT.

I think your son being upset about the financial mistake he made, it shows the teaching your provided him about money and effect it made. Also that he could learn from it as he moves on hopefully remembers it the next time he is in another financial dilemma.

So happy to hear your son’s school is teaching personal finance. Hopefully there will be a lessons on dealing with credit cards, debt and the perks of compounding.

Chrissy

May 21, 2019 at 8:10 pmBelieve me, if I didn’t have a tween and teen in my house, I’d also have no idea what Fortnite is! Yes, it’s a videogame and it’s been the hottest thing for the last year and a half. It’s kind of crazy how popular it’s been.

I never would’ve expected it to lead to money lessons for my kids. But it’s good for them to learn from small mistakes like this now. Better to learn now, while the stakes are low!

Thanks for stopping by to comment Kris. 🙂

Brian

July 14, 2019 at 1:55 pmI’m with you on sharing the numbers. I’ve been blogging for 7 months and haven’t done a “reveal” spreadsheet. I feel as though if you are targeting an FI number that is based on expenses, then it really doesn’t matter what that number is, as long as it’s realistic. It’s more about the method and mindset than the actual number.

Chrissy

July 14, 2019 at 8:45 pmI’m glad I’m not the only one who’s shy about revealing my numbers! I’d love to just for the educational aspect, but maybe in the future! I’m intrigued by your thoughts on targeting a FI number based on expenses. Have you written an article about that?